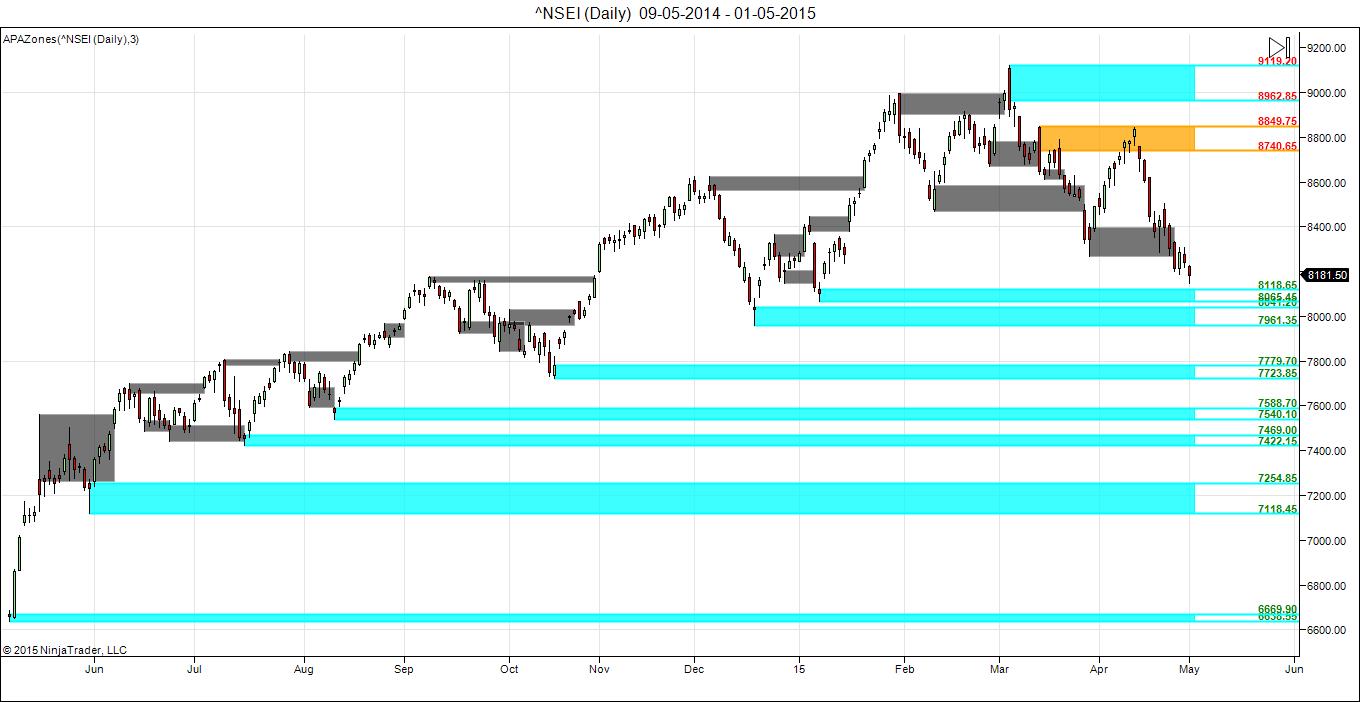

- Nifty formed hammer pattern on last day of expiry, April expiry has been very volatile with move of 698 points (8844-8146) and close was almost near the lowest of the series. We closed the April month at lows also closing below 200 DMA for 2 day in a row. I have shown Supply and Demand chart below for Nifty.Range of 8118-8065 is very important demand zone, nifty if held this zone can see bounceback till 8309 odd levels. Unable to hold the range we can see a swift move towards 7961 odd levels. Range for May Month comes in range of 8856-7506. Harmonic pattern shows butterfly pattern can form if 8116/8065 range hold.How Much Money Do You Really Need To Trade For A Living

- Nifty May Future Open Interest Volume is at 1.89 core with addition of 43 lakhs Series is starting at very low Open Interest seen in next last 6 months.Rollover has started and we are seeing 65.5 % rollover around 8295.

- Total Future & Option trading volume was at 6.27 core with total contract traded at 8.1 lakh. PCR @0.84

- 8500 CE OI at 23.9 lakh , wall of resistance @ 8500 .7900/8500 CE saw addition of 28.4 lakhs ,so bears added fresh position.

- 8100 PE OI@29.3 lakhs so strong base @ 8100. 7900/8500 PE added 19.2 lakh so bulls are also adding on to positions at lower levels.

- FII’s sold 3157 cores in Equity and DII’s bought 2460 cores in cash segment.INR closed at 63.43.Highest FII sell in past 6 months.

- Nifty Futures Trend Deciding level is 8233 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8288 and BNF Trend Deciding Level 18215 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18555 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8186 Tgt 8200,8229 and 8269 (Nifty Spot Levels)

Sell below 8141 Tgt 8100,8080 and 8056(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Thanks brahmesh bhai for all ur efforts in guiding us selflessly..we all r bounded by passion to learn and earn daily..

Can I get your email id.

bhandaribrahmesh@gmail.com

Yes. I hv read dose and traded too many times and earned by usin ur trend changer and deciding level method..thx .. basically qstn was correlation of these levels with gann day move..bt i got ur answer tht ” trade according to the levels”. 🙂 thx champ gbu

Gann is for Intraday Move and TC is Positional, Never mix time frame when trading.

Stick to one.

Rgds,

Bramesh

Brahmesh sir , are nifty trend changer and Trend deciding level validated on a gann day .bcuz generally one side move on gann day is a one day phenomenon..wil closing abov this levels today change trend of mrkt? Thx and reg

Please read How to trade NF using TC levels (Link given in above post)

Rgds,

Bramesh

Fii activity is not bullies fii option activity not analises by you in option fii what positon made by fii on thuresday please analises fii option activity on thuresday

sir below 8140 H&S will be in scene ???? your inputs required

may expiry 8340 to 7910 spot