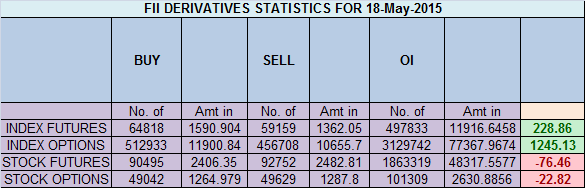

- FII’s bought 5.6 K contract of Index Future worth 228 cores,1.2 K Long contract were squared off by FII’s and 6.9 K short contracts were squared off by FII’s. Net Open Interest decreased by 8.2 K contract so today’s rise was used by FII’s to squared off both longs and shorts in Index Future. Are you a Loss making trader ?

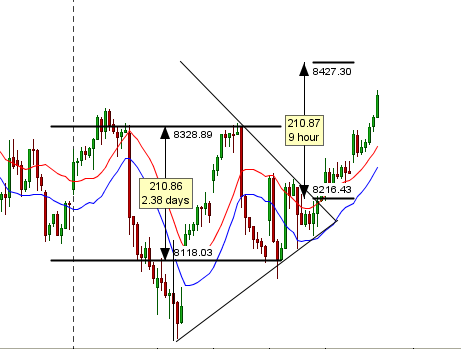

- As discussed in last analysis Triangle pattern in hourly pattern as shown in below chart, has broken on upside, we need to see follow up move on Monday. Gunner is also entering new quadrant and pyrapoint analysis suggests Nifty is ready for an explosive move. Nifty obliged by showing an explosive move on upside. Real test of Bulls will come in next 2 session as range of 8414-8430 should be closely watched,unable to close above it can lead market correcting back to 8230-8250 odd levels. Nifty Fibonacci Fans has resistance @ 38.2% and Pyrapoint also suggests 8396-8405 range as trend changer so caution advised on longs.

- Nifty May Future Open Interest Volume is at 1.36core with liquidation of 3.8 lakhs with cost of carry going posiitve suggesting long position got closed. OI is lowest in last 3 months, such low OI generally suggests trending move is round the corner.

- Total Future & Option trading volume was at 2.23 core with total contract traded at 4.1 lakh. PCR @1 .05 approaching overbought zone.VIX declined big time saw a cut of 9%.

- 8500 CE OI at 46.9 lakh , wall of resistance @ 8500 .8100/8400 CE saw liquidation of 20 lakh ,so bears hit panic button today but still holding 73 lakh open position. FII bought 15.9 K CE longs and 46.9 K shorted CE were covered by them.Retailers also sold 1.12 lakh of CE position

- 8100 PE OI@ 53.3 lakhs so strong base @ 8100. 8100/8400 PE added 37.7 lakh so bulls are gaining ground and holding 60 lakh open position. FII bought 22.4 K PE longs and 29.1 K shorted PE were covered by them. Retailers have bought 138 K PE contracts in today’s session.

- FII’s sold 202 cores in Equity and DII’s bought 618 cores in cash segment.INR closed at 63.72

- Nifty Futures Trend Deciding level is 8326(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8241 and BNF Trend Deciding Level 18306 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18107 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8384 Tgt 8414,8456 and 8504 (Nifty Spot Levels)

Sell below 8340 Tgt 8302,8275 and 8250(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates