- FII’s sold 64.3 K contract of Index Future worth 1386 cores,46.1 K Long contract were squared off by FII’s and 18.1 K short contracts were added by FII’s. Net Open Interest decreased by 28 K contract.

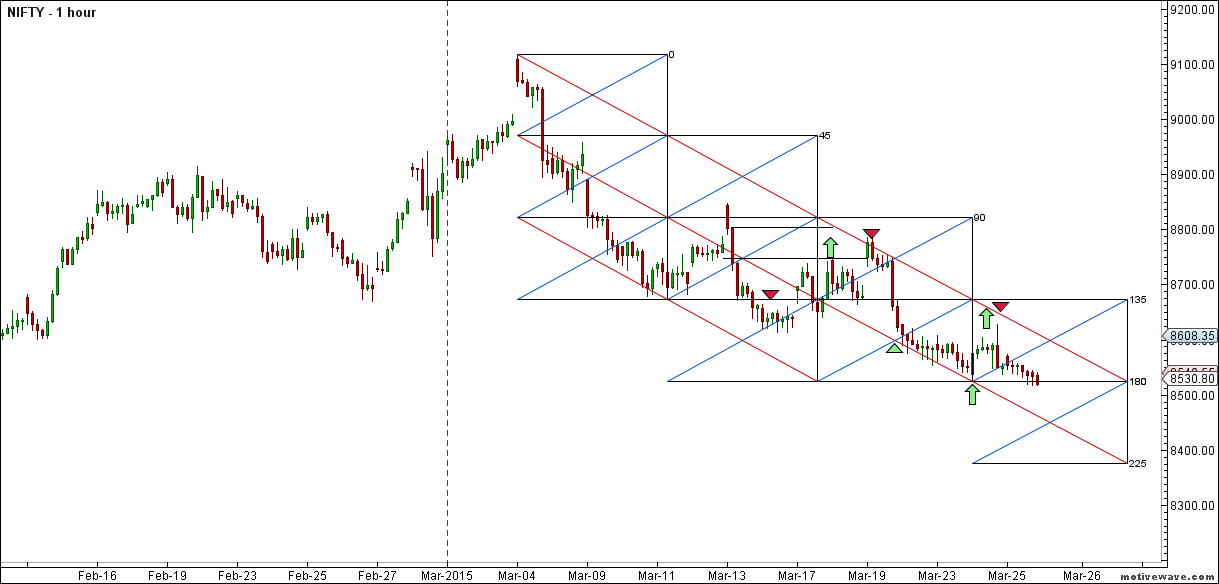

- Nifty closed near its 100 DMA and near trendline support. As per Pyrapoint Analysis Nifty is trading near its 180 degree line but today was not able to cross and close above 8600. Gann Box also suggests we are entering a support zone and shorts should be cautious.As discussed yesterday We can see another round of decline till 8497 if 8550 on Nifty is broken , tomorrow need to watch 8470 level holding the same can see a good bounce as today is 15 day of correction time wise and as last correction was 666 points so we can see 8453 odd levels (9119-666)

- Nifty March Future Open Interest Volume is at 1.10 core with liquidation of 58.6 lakhs and same got rollovered in April Series, Rollover have started and 58.2% rollover were witnessed today with average rate of 8661.

- Total Future & Option trading volume was at 3.57 core with total contract traded at5 ,lakh. PCR @0.85 lower end of trading range.

- 8600 CE OI at 50.4 lakh ,wall of resistance @ 8600 so expiry should be below 8600. FII bought 25.9 K CE longs and 6.1 K CE were shorted by them.

- 8500 PE OI@ 58.5 lakhs so strong base @ 8500. 8450/8500 PE OI should be seen in morning trade to get further cue of expirym Max pain as per option comes @8500.FII bought 53.2 K PE longs and 8.3 K PE were shorted by them.

- FII’s bought 737 cores in Equity and DII sold 631 cores in cash segment.INR closed at 62.26.

- Nifty Futures Trend Deciding level is 8553 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8615 and BNF Trend Deciding Level 18393 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18850.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8541 Tgt 8564,8597 and 8621 (Nifty Spot Levels)

Sell below 8507 Tgt 8483,8449 and 8420 (Nifty Spot Levels)

Upper End of Expiry:8589

Lower End of Expiry:8472

Click Here to Like Facebook Page get Real time updates

Bramesh,

Ur nifty levels reading is excellent.Downside ur tgts met,i have a doubt,last 2 days u r saying shorts should be cautious.bt wn sell of started at morning 8470 fut levels,not bears actually bulls was in trouble na?and lower end of expiry is well below the stated level 8479..how we can analyses this new level 8342?any chance once again retest 7965 and+/- 100 points?

Yes i was advocating short should be caution as it was near 100 SMA and trendline support, and market has bounced before so caution was advised.

Will discuss further nifty moves in my post.

Rgds,

Bramesh

Dear Bramesh,

Can you provide me the bank nifty level for April contract.

Regards,

Prem

Hi Bramesh….

Nifty will continue fall in April too ? what’s target of nifty for April Expiry

nifty will close above 8600 today

Sir,

Thanks for the analysis.

In the first paragraph, did FII’s square off 46.1k long contracts or added? Pls confirm.

Regards,

Shankar

square off

Great

Dow NASDAQ huge selloff guys what’s support for nifty