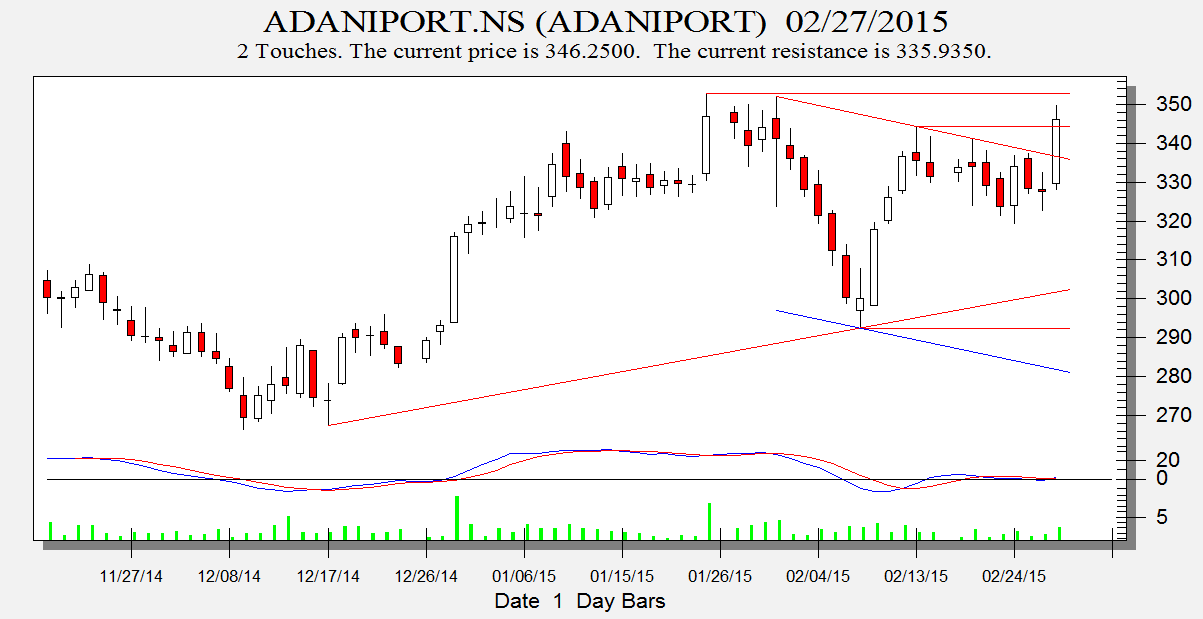

Adani Port

Any close above 356 stock is heading to 364/369 and 377. Any close below 343 short term target 322.

Intraday Traders can use the below mentioned levels

Buy above 350 Tgt 354,363 and 375 SL 346

Sell below 340 Tgt 333,328 and 322 SL 344

Petronet

178 should be watched for Petonet Holding the same stock is heading to 199.

Intraday Traders can use the below mentioned levels

Buy above 185 Tgt 186.4,189 and 193 SL 183

Sell below 180 Tgt 178,174 and 171 SL 183

IGL

Holding 432 stock is heading to 466

Intraday Traders can use the below mentioned levels

Buy above 440 Tgt 444,448 and 455 SL 438

Sell below 436 Tgt 428,425 and 418 SL 438

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for February Month, Intraday Profit of 2.81 Lakh and Positional Profit of 3.74 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

The post given here are My Personal views and for learning purpose, trading or investing in stocks is a high risk activity. Any action you choose to take in the markets is totally your own responsibility. I will not be liable for any, direct or indirect, consequential or incidental damages or loss arising out of the use of this information.

In this performance list Itc missing ????

Hi

Your advise are very helpful. Which software we should refer to study these type of chart making?

Please advise on the TATASTEEL and Jindalsteel.