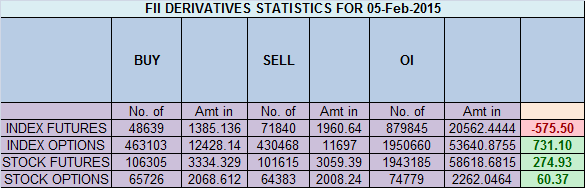

- FII’s sold 23.2 K contract of Index Future worth 575 cores, 23.5 K Long contract were squared off by FII’s and 343 short contracts were squared off by FII’s. Net Open Interest decreased by 23.8 K contract ,so FII’s squared off both shorts and long in Index Futures.

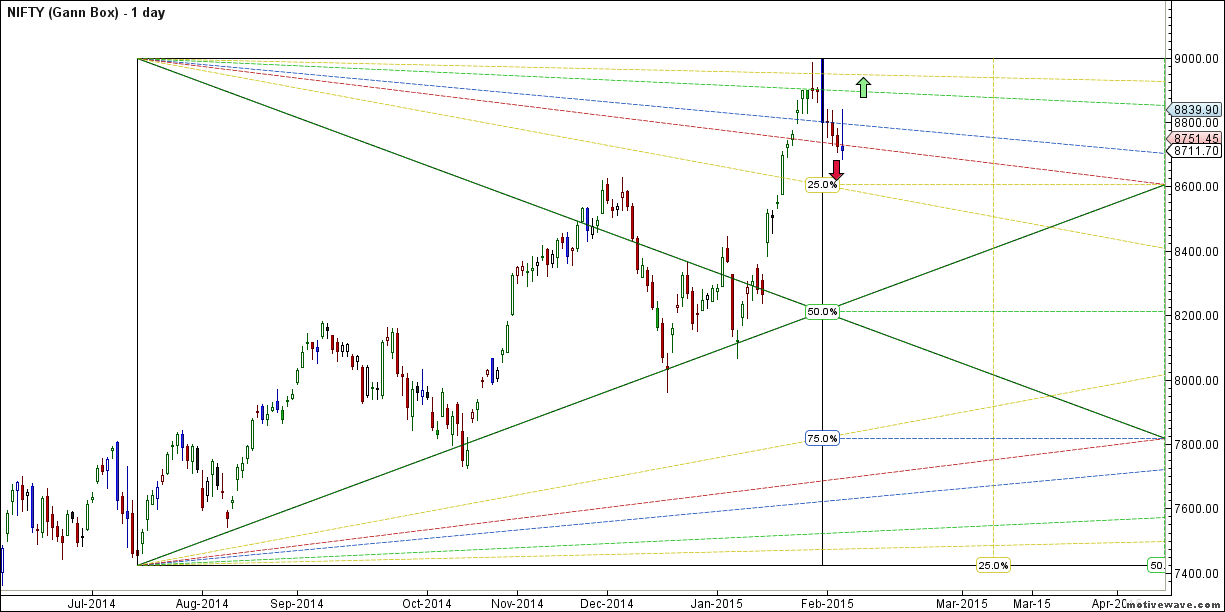

- Nifty corrected for fifth day in a row with wild swings happening in market, Nifty fall is lead by banks and bank nifty is near an important AF support as seen in bottom chart and nifty is not able to break the red line of gann box convincingly keeping both bulls and bears in state of confusion. Intraday volatility is also huge whipsawing traders on both side. As i always say in my article when unable to understand market moves better to stay out and sit on sidelines and protect your trading capital.As i discussed in my weekly analysis 5 is very important gann date and effect were seen with nifty 100+ up to -50 point giving a total 174 point move.

- Nifty Future Feb Open Interest Volume is at 2.48 core with liquidation of 4.4 lakhs so bulls liquidated longs today in volatile session today.

- Total Future & Option trading volume was at 2.08 core with total contract traded at 5.7 lakh. PCR @0.94, as we expected last analysis relief rally can come

- 9000 CE OI at 50.8 lakh so wall of resistance @ 9000 .8800/8900 CE added 3.3 lakhs and 17 lakhs in 2 days so bears are holding shorts , and creating resistance at higher levels. FII bought 23.8 K CE and 2 K shorted CE were covered by them.

- 8500 PE OI@ 29.7 lakhs so strong base @ 8500. 8700/8800 PE added another 2.4 and 16 lakh in OI in 2 days so bulls are still holding on , next 2 days will be interesting as we will see trending move and one party will have to cover the positions.This kind of market are good for option writers. FII bought 13.3 K PE and 6.5 K PE were shorted by them.

- FII’s sold 27 cores in Equity and DII bought 325 cores in cash segment.INR closed at 61.73.

- Nifty Futures Trend Deciding level is 8806 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8862 and BNF Trend Deciding Level 19333 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 19878.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8740 Tgt 8776,8792 and 8828 (Nifty Spot Levels)

Sell below 8704 Tgt 8688,8652 and 8600 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Bramesh Sir ji, 2% of my gross income goes to a temple , I donate well-stitched good clothes to unknown recievers, My name is on the donors for daily food to thousnds of pilgrims visiting a temple,apart from daily giving of small sweets.So you and I can heartily share sweets ! I am from Hyderabad. Thank- you, for your words.

Dear Sir,

Thank you are being a great human being and helping the needy. I feel honoured to have interacted with you. I also live in Hyd please contact me @09985711341.

Rgds,

Bramesh

Greetings of the day , Whats your view on ONGC.

Its have quarterly results on 12 Feb .

can u please suggest nhpc levels

Bullish above 21 tgt 23

Thankssss!!!

After stumbling into your site,we have yet to make money.But how do I send you a box of sweets.Thank-you, Brameshji.

Dear Sir,

Am happy you are liking the site and my analysis is helping you.

Please donate the box of sweet to few needy fellow you find in your city.

Rgds,

Bramesh

kudos for your kind efforts to educate us. if BJP loses in Dehli, expect a big downside in Nifty. and this possibility seems to be high.

Hv u ever lost money in trading

Trading is a Business, Every business will have losses.

Rgds,

Bramesh

With so much knowledge, you still have humility and honesty. Rare in a person. Really appreciate the hard work you put in and the way you manage this blog.