- FII’s sold 6.7 K contract of Index Future worth 176 cores, 2.1 K Long contract were squared off by FII’s and 4.5 K short contracts were added by FII’s. Net Open Interest increased by 2.4 K contract ,so FII’s squared off long and added shorts in Index futures.

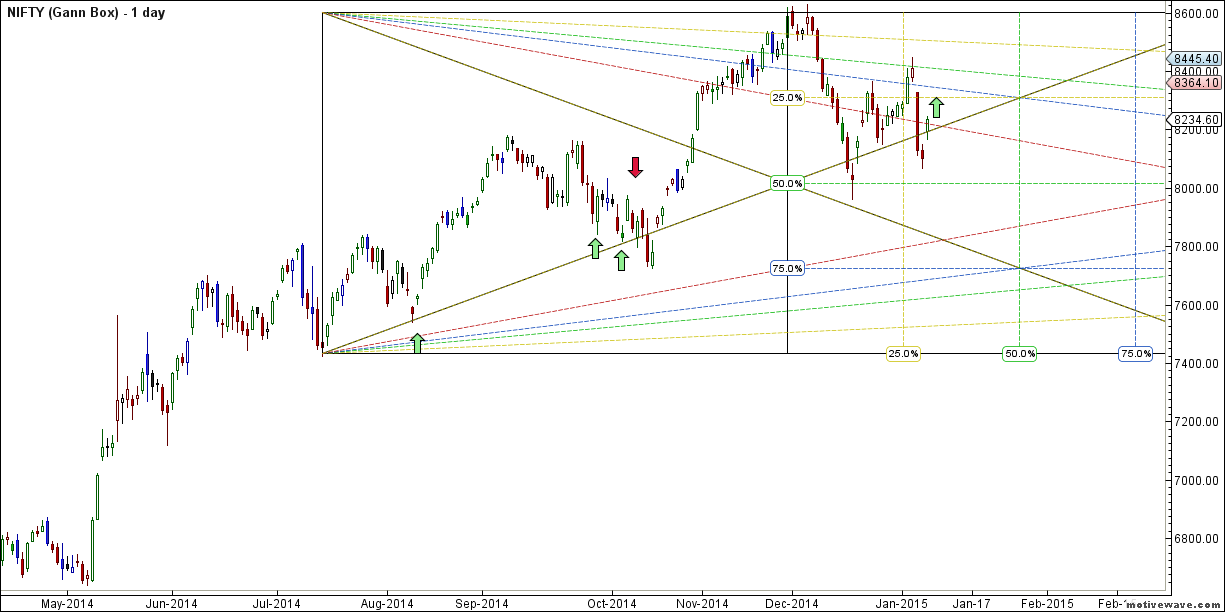

- This is what we discussed yesterday Nifty hourly chart touched the support line and formed a doji candlestick pattern similar to the one @ lows 7961 signalling short term bottom . Tomorrow going by historical data we should see gap up opening, and need to see a rally till 8200/8232 odd levels. Nifty opened with a gap up and closed at 8234. Now expect another gap up tomorrow going by historical data and traders should watch 8325-8320 range where next level of resistance lies ie. yeallow line of gann box as shown in below chart.

- Nifty Future Jan Open Interest Volume is at 1.77 core with liquidation of 9.1 lakh in OI, short covering seen today.

- Total Future & Option trading volume was at 1.68 lakh core with total contract traded at 4 lakh. PCR @1.05.

- 8400 CE OI at 53.9 lakh so wall of resistance @ 8400.8200/8400 CE saw liquidation of 19.2 lakhs so bears were taken off the guard and running for cover. FII bought 18.3 K CE and 10 K CE were shorted by them.

- 8100 PE OI@ 47.3 lakhs so strong base @ 8100. 8200 PE added 4 lakh in OI 8200 PE writers are getting confident of holding and 8300/8500 added 10 lakh in OI so bulls are back with bang. FII bought 8.8 K PE and 4 K shorted PE were covered by them.

- FII’s sold 466 cores in Equity and DII bought 288 cores in cash segment.INR closed at 62.66 biggest fall in recent time.

- Nifty Futures Trend Deciding level is 8233 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8305 and BNF Trend Deciding Level 18687 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18815 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8245 Tgt 8262,8291 and 8339 (Nifty Spot Levels)

Sell below 8215 Tgt 8186,8150 and 8120 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Now expect another gap up tomorrow going by historical data and traders should watch 8325-8320 range — And that’s what happened. Precise prediction.

Sir how can u predict gap up or gap down according to historical data. Very keen to know about it.

Thanks All !!

Thank you sir

Your yesterday’s statement that “Tomorrow going by historical data we should see gap up opening, and need to see a rally till 8200/8232 odd levels.” came true when NIFTY in fact opened gap up and closed at 8234.60 ………………… Hats off to you. I am now keenly observing your today’s statement “Now expect another gap up tomorrow going by historical data and traders should watch 8325-8320 range where next level of resistance lies ie. yeallow line of gann box”

Regards.

Now expect another gap up tomorrow going by historical data and traders should watch 8325-8320 range where next level of resistance lies ie. yeallow line of gann box as shown in below chart.

thi s mean by historical ldata selling expected inthe resistance levels again to lows?

syamala