I am not a SEBI Registered Advisor, and the analysis provided on this website is intended solely for educational purposes. It is important to note that the information presented should not be construed as financial advice. We do not guarantee the accuracy or completeness of the content, and any decisions based on the information provided are at your own risk.

Please be aware that investing in financial markets involves inherent risks, and past performance is not indicative of future results. We, the authors and contributors, shall not be held responsible for any financial outcomes, including but not limited to profit or loss, arising from the use of the information on this website.

It is strongly recommended that you seek the advice of a qualified investment professional or a SEBI Registered Advisor before making any investment decisions. Your financial situation, risk tolerance, and investment goals should be carefully considered before implementing any strategies discussed on this platform.

Additionally, we may not be aware of your specific financial circumstances, and our content should not be considered a substitute for personalized advice. Always conduct thorough research and consult with your own investment advisor to ensure that any investment decisions align with your individual financial objectives.

By accessing and using the information provided on this website, you acknowledge and agree that you are solely responsible for your investment decisions. We disclaim any liability for any direct or indirect damages, including financial losses, that may result from the use of or reliance on the information presented here.

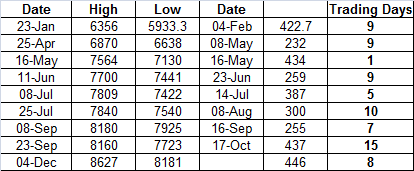

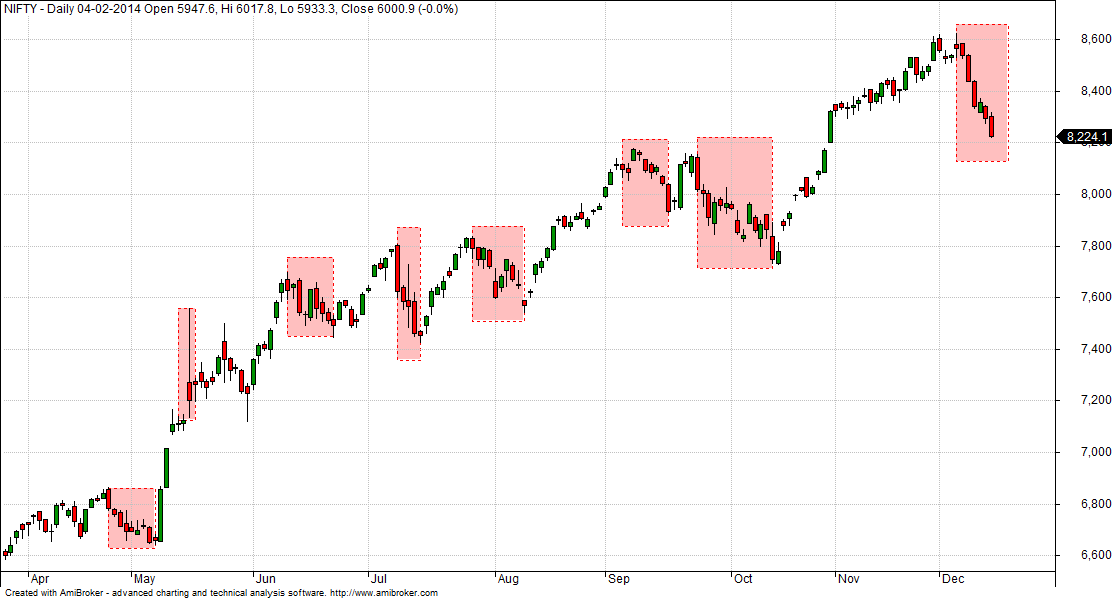

8216 to 8171 is a Strong Support Zone on muliple counts. But my feeling is Nifty is headed further down. Bank Nifty is yet to crack. Once it lends a helping hand 8100 and 8000 are on the cards.

Thank you sir

Fantastic trend analysis…this shows how creative you are…. I superliked it… Keep the good work up…. Can we connect you on social networking site like fb ???

https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Trend is your friend. My suggestion would be to take position only if get a clear trend reversal. Two conditions to satisfy to confirm trend reversal. One is close EOD Candlestick above previous day high and second is open, high, low and close is above previous day candle. Once this criteria is satisfied you can safely go long. You may loose few points but its worth it as you can ride the remaining wave. Same logic holds in case of reverse side also.

This month Low mentioned as 8181, you decided already?

Its my assumption..

Any paid service from your side ???

Nope I do not have any paid service.

bramesh – would u buy call options on Monday given there wold be agap down of atleast 60-80 points or u wld wait for some confirmation on hrly chart

Wil wait for trading level of my Quadrant system to trade

Dear Bramhesh,

Can we expect a new high in nifty by dec 31st or before 15th Jan 2015..Can we expect any Rate cut and can we feel that closing session of parliament can trigger some major reforms in next week?

Bramhesh

Is there any possibility to hit 9K in Jan series???..Still can we expect Santa rally or no way..have seen ur post on dec startegy..only 1 dec month has given negative return while all other dec’s were positive..so can we expect a positive close above nov expiry or negative close.