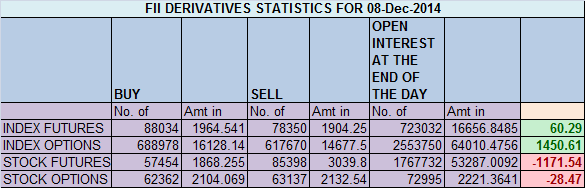

- FII’s bought 9.6 K contract of Index Future worth 60 cores, 18.1 K Long contract were added by FII’s and 8.4 K short contracts were added by FII’s. Net Open Interest increased by 26.4 K contract ,so FII’s added long in Index Futures and also added shorts in index future.

- Nifty after 34 days of rise saw 1% decline, after last few days of sideways move, Has it started a fresh downtrend or another opportunity for Buy on Dips before the commencement of Santa Rally. Keep close eye of 8411 level which is 23.6% retracement from High of 7723-8624. Breaking the same should see Bulls taking a back seat else its a dip in ongoing uptrend. Nifty has also corrected 195 points from high suggesting the current uptrend has come to an end and now rangebound moves can be seen in range of 8400-8700 before any trending move.

- Nifty Future December Open Interest Volume is at 2.13 core with addition of 11.6 lakh in OI suggesting shorts addition.

- Total Future & Option trading volume was at 2.06 lakh core with total contract traded at 4.03 lakh. PCR @0.92.

- 8600 CE OI at 62.9 lakh so wall of resistance @ 8600.8800/8900 CE saw liquidation of 15.5 lakh so finally speculative buying is out of the system.FII sold 28.9 K CE and 10.5 K CE were shorted by them.

- 8500 PE OI@ 56.5 lakhs so strong base @ 8500 . 8400 PE added 4.1 lakh in OI so strong base building happening @8400. FII bought 108 K PE and 2.4 K shorted PE were covered by them.FII has bought big PE qty today but its more of hedging as seen in last month data.

- FII’s bought 4985 cores in Equity and DII bought 1030 cores in cash segment.INR closed at 61.85, Big buy figure is due to Infosys share buy by FII’s.

- Nifty Futures Trend Deciding level is 8520 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8582 and BNF Trend Deciding Level 18704 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18633 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8473 Tgt 8512,8546 and 8587 (Nifty Spot Levels)

Sell below 8432 Tgt 8400,8380 and 8360 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Since both nifty fut and bank nifty fut close today are decisively below their respective trend change levels, is it a clear cut indicator that there is going to be a deep cut in both the index futures in particular and the market in general.

Yesterday’s move excellent. Gann date on dot !!