Ranbaxy

Any close above 610 stock is heading towards 623/631.

Buy above 600 Tgt 603,608,615 SL 598

Sell below 596 Tgt 592,585 and 580 SL 598

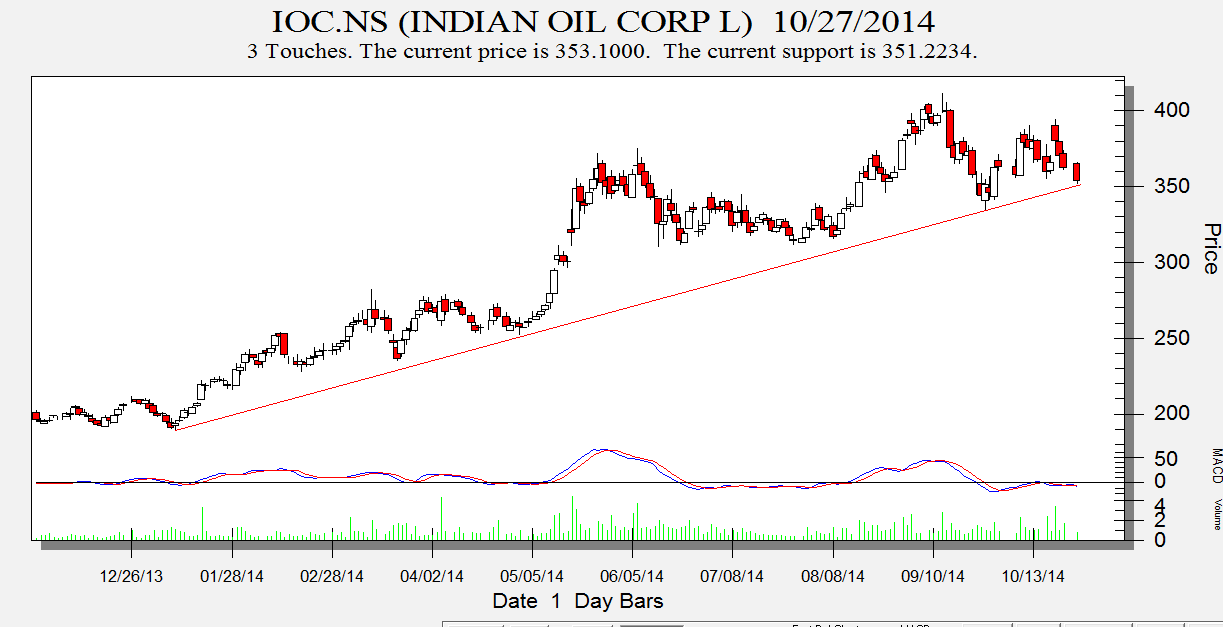

IOC

Buy above 357 Tgt 361,365 and 371 SL 354

Sell below 351 Tgt 348,343 and 338 SL 353

Just Dial

Any close 1450 stock is heading towards 1410 and 1364.

Buy above 1463 Tgt 1472,1488 and 1538 SL 1453

Sell below 1440 Tgt 1420,1390 and 1364 SL 1453

How to trade Intraday and Positional Calls — Click on this link

Performance sheet for Intraday and Positional is updated for September Month, Intraday Profit of 3.58 Lakh and Positional Profit of 2.09 Lakh

http://tradingsystemperformance.blogspot.in/

http://positionalcallsperformance.blogspot.in/

- All prices relate to the NSE Spot

- Calls are based on the previous trading day’s price activity.

- The call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

hi your analysis are excellent i track them daily. your blog gives a true traders way. it open up eye for right trade. grt work keep going on..

Sir..We continously get to learn from you..I was looking at the September positional performance sheet..but I am little confused about the Sep entry for Crompton greaves stock in your positional performance sheet..the entry and stoploss levels in the technical analysis report don’t match with the actual entries in the performance sheet..can you please clarify on this?

One more question is for eg whenever you mention buy above 212 or sell below 208…do we have to wait for stock to go above or down by 1 rupee to get clear direction..on what basis we should take crisp entries at mentioned price?

This is what i have mentioned

Close below 220 stock is heading back to 212. Where is the confusion please let me know.

Please read the article how to trade intraday positional levels to get more clairty.

what are the future targets for ranbaxy ahead of 631?

just dial +——–

Excellent Ananlysis

Thank you sir.