Last week we gave Nifty Chopad level of 16086 Bank Nifty opened with big gap up made low of 16157 and marched higher made a fresh all time high,As we have FOMC meeting and expiry lying ahead so trades should trade caution as wild moves are bound to come in bank nifty. Lets analyze how to trade Bank Nifty in coming week.

Bank Nifty Hourly

This sis what we discussed in last analysis Bank Nifty hourly charts are trading in contracting triangle, triangle breakout comes above 15150, if broken and closed over it bank nifty is heading to new high towards 16309 by Mahurat trading session. New High was made one day before Mahurat session, Now long should be cautious and profit booking is advisable.Trendline target comes @ 17000.

Bank Nifty Hourly Elliot Wave

Bank Nifty hourly EW is shown as above.Correction can be seen till 16205 than a rise till 16800/17000.

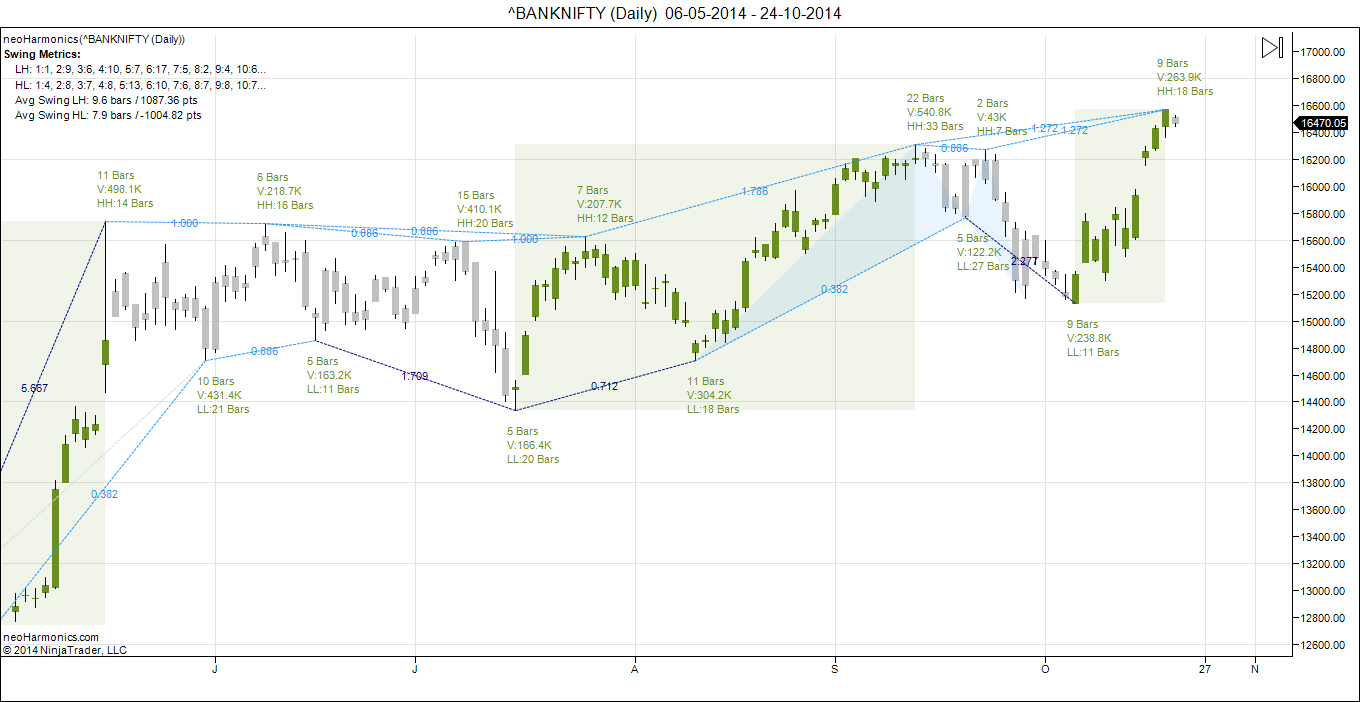

Bank Nifty EW Daily

Bank Nifty daily chart is showing the completion of 5 wave, so profit booking is advised on long and dips should be used to buy around 16000/16200 levels.

Bank Nifty Daily Bias

As per above analysis we have been mentioning the same from past few weeks

Bank Nifty daily chart after fall of 1000 points is still in neutral zone suggesting underline trend is still bullish and dip in bull market correction needs to be bought into.Traders who bought the dips must have been rewarded handsomely, more to come .

Now its time to book profit and wait for dips to reenter again around 16000 odd levels.

Bank Nifty Gann Dates

As per time analysis 29 October is Gann Turn date , except a impulsive around this date. Last week we gave 20 October is Gann Turn date and Bank Nifty was up by 300 points on that day.

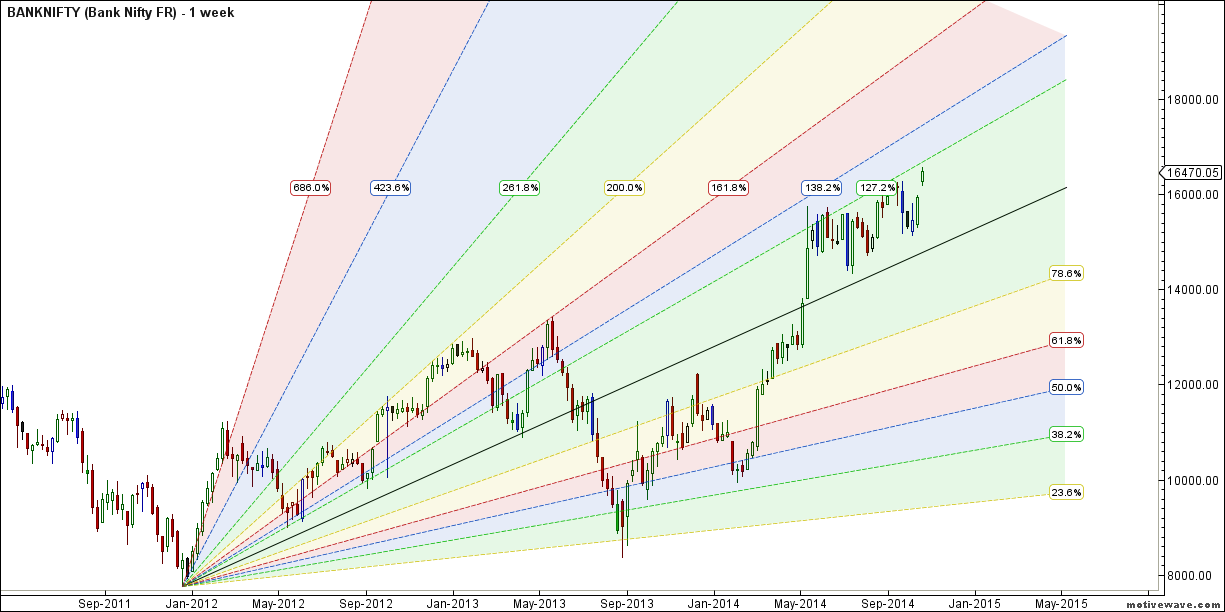

Fibonacci technique

Fibonacci Fans

Bank nifty is now entering in resistance zone of 16600 odd levels, unable to cross can see pullback till 16000 odd levels.

Bank Nifty Weekly

Bank Nifty Weekly chart is in bullish zone as per Harmonic theory, Means dips coming should be bought into. Negative weekly cycle has come to an end and we started seeing bullish move from past week, which should be continued forwards.As per AF bank nifty target is also done,so now its time to book profit.

Bank Nifty Monthly

Bank Nifty is also approaching the trendline on upside signalling bulls are in full control.

Bank Nifty Weekly Chopad Levels

Bank Nifty Trend Deciding Level:16476

Bank Nifty Resistance:16606,16836,16996

Bank Nifty Support:16346,16216 and 16086

Levels mentioned are Bank Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

what is the “Bank Nifty Weekly Chopad Levels” …. Chopad levels mean?