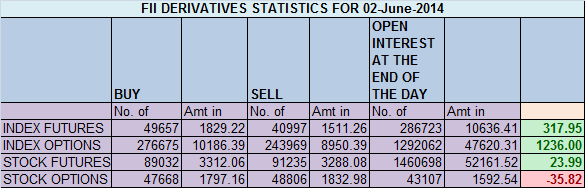

- FII’s bought 8.6 K contract of Index Futures worth 317 cores (1.8 K longs were added and 6.8 K shorts were squared off in Index Future) with net OI decreasing by 5 K contracts.FII’s squared off shorts taken on Friday and went long before RBI event.

- As discussed in Weekly Analysis Nifty as per Gann grid is having strong support at red line marked by Green arrow and strong resistance in red line as shown with red arrow in below chart. Nifty took exact support at 7239 green line and is moving near the green line in range of 7430-7450. Will RBI surprise the street ?

- Nifty Future May Open Interest Volume is at 1.65 cores with liquidation of of 1.8 lakhs in Open Interest, suggesting short liquidation.

- Total Future & Option trading volume at 1.33 lakh core with total contract traded at 2.2 lakh.PCR @0.75

- 7500 Nifty CE is having highest OI at 47.9 lakhs remains the strong resistance of the market, followed by 7400 CE. FII’s bought 47.1 K CE longs and 22.3 K CE were shorted by them suggesting range bound move in next few session can come.

- 7200 PE OI at 29.9 lakh remains a strong support from start of series, 7300 PE added huge 13.1 lakhs suggesting support at 7300 for next few days, .FII’s bought 19.1 K PE longs and 11.1 K PE were shorted by them.

- FIIs bought 234 cores in Equity and DII sold 148 cores in cash segment.INR closed above 59.15.

- Nifty Futures Trend Deciding level is 7325 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7293 and BNF Trend Changer Level (Positional Traders) 15038 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . NF gave 100 points for TC level.

Buy above 7373 Tgt 7407,7452 and 7504(Nifty Spot Levels)

Sell below 7320 Tgt 7300, 7278 and 7240 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

How come prices moved so much and OI decreased? Did prices increase due to short covering? If there is significant strength in the move OI should have increased. I am new to trading and trying to grasp these concepts.