- FII’s sold 13139 contract of Index Futures worth 444 cores (10.1 K longs were squared off and 3 K shorts were added in Index Future) with net OI decreasing by 7 K contracts.

- Nifty closed below its 20 DMA for 5 day in row which is bearish in short term, but momentum is missing on downside suggesting bears are unable to capitalize on the downside. As per time analysis bulls will make a rally of 80-100 points in next 1-2 days and close nifty above 20 DMA. Elliot wave always shows the same possibility as shown in below chart. Low of 6656 should be held for the above scenario to materialize.

- Nifty Future May Open Interest Volume is at 1.29 cores with liquidation of of 2.4 lakhs in Open Interest, suggesting liquidation of bullish positions which got added yesterday.

- Total Future & Option trading volume at 0.54 lakh core with total contract traded at 1.3 lakh , PCR (Put to Call Ratio) at 0.70 suggesting oversold market.

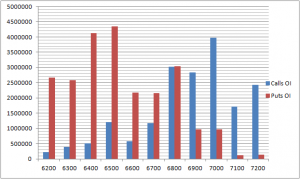

- 7000 Nifty CE is having highest OI at 38.4 lakhs , resistance for the market with liquidation of 2.3 lakh suggesting bears liquidating position sign of bounceback, 6800 CE with OI at 29.4 Lakhs,saw liquidation of 2.2 lakhs suggesting bears are liquidating position on 6800, 7100-7200 CE added 6.6 lakh suggesting informed buying by smart money. FII’s bought 19.3 K CE longs and 17.4 K CE were shorted by them.6300-7000 CE added 5.3 lakhs.

- 6500 PE is having highest OI at 43.3 lakh remains a strong support for the series, 6800 PE saw liquidation of 1.7 lakhs in OI.FII’s bought 329 PE longs and 23.7 K PE were shorted by them.6300-7000 CE added 7.2 lakhs. Looking at Option data it seems FII’s are playing for range bound move from 6600-6800.

- FIIs bought 45 cores in Equity and DII sold 55 cores in cash segment.INR closed above 60.09.

- Nifty Futures Trend Deciding level is 6750 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6791 and BNF Trend Changer Level (Positional Traders) 13075 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6720 Tgt 6739,6762 and 6780 (Nifty Spot Levels)

Sell below 6697 Tgt 6679, 6655 and 6640 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hey Friends,

It is good to see there are so many followers for Bramesh. As he is good in his readings. Also good to see some really good questions being asked to Bramesh. He is a good human being who goes all out to help the investors on his blog.

Keep it up

I thank some typing errors

Hi,

Even i have the same query bhai… I think its the same line from yest’s post mistakenly posted, or are we missing something….

Vishal

Mr. Bramesh,

It can be seen that FII’s have squared off 10.1 k longs & added 3k shorts. From this how can we say that FII’s added substantial amounts of longs in index futures.

Please help me in understanding this.

Thanks & Regards,

Vikram

Its corrected !! What i meant was substantial amount of Call Options got added today..

Rgds,

Bramesh