- FII’s sold 7265 contract of Index Futures worth 258 cores (4.8 K longs were squared off and 2.3 K shorts were added in Index Future) with net OI decreasing by 2.4 K contracts.FII’s were square off more today.

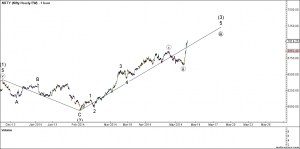

- This is what we discussed in past analysis As per classic TA Bulls market take support at 50% or 61.8% which in our case is 6587 for bounceback. To test of Bull market will be seen in next 2 trading session. As per EW if 6580-6618 is strong support zone holding the same we can see 7000-7200 levels. Nifty made a history today by closing above 7000, Tomorrow looking at exit poll reaction SGX trading at 6174 suggesting gap of 150-200 points on cards, Near 7220-7250 range traders should book some profit.

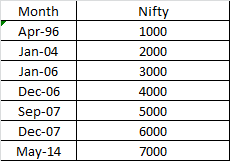

Time taken by Nifty to cross 7000

- Nifty Future May Open Interest Volume is at 1.49 cores with addition of of 4.3 lakhs in Open Interest, suggesting long addition with increase in cost of carry.

- Total Future & Option trading volume at 1.55 lakh core with total contract traded at 3.2 lakh , PCR (Put to Call Ratio) at 0.50 suggesting oversold market.VIX will also decline tomorrow so we can see a big fall in option prices.

- 7000 Nifty CE is having highest OI at 54.3 lakhs followed by 7200 CE, so 7200 can offer some resistance of market tomorrow ,7500 CE saw a huge addition of 16 lakh in OI suggesting smart money bought before the announcement of exit polls, FII’s bought 27.8 K CE longs and 67.3 K CE were shorted by them such a huge addition in call short indicates VIX will see a fall and leading to fall in option prices even though Nifty will rise.

- 6400 PE is having highest OI at 58 lakh remains a strong support for the series, 6500 PE saw added of 8.4 lakhs in OI. OTM PE is having very high premium and informed and smart buyers are slowly writing the options to take advantage of high vix and time value erosion. FII’s bought 39.3 K PE longs and 56.5 K PE were shorted by them.

- FIIs bought 1217 cores in Equity and DII bought 92 cores in cash segment.INR closed above 60.05.

- Nifty Futures Trend Deciding level is 6997 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 67794 and BNF Trend Changer Level (Positional Traders) 13200 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7116 Tgt 7148,7197 and 7246(Nifty Spot Levels)

Sell below 6966Tgt 6950, 6910 and 6870 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Dear sir,

Thank you very much on your options view that all the values of options will fall down….. i followed your suggestion and you saved my money!!!!!

Sir do you think that on 16 th or 19 th may we can see rally of 7to8% on nifty or just 100 points rally….. what dou you think

Dear Rahul,

I do not think/assume anything. Lets stick to plan and trade with peace.

Rgds,

Bramesh