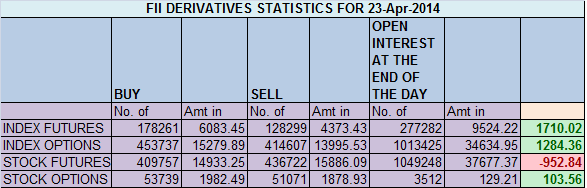

- FII’s bought 49962 contract of Index Futures worth 1710 cores with net OI decreasing by 2 lakh contracts. So on expiry day FII’s squared off most of shorts they were carrying as rollover in the Nifty at around 59% is lower than the three-month average of 65%, indicating FII’s sees the risk of taking bullish or bearish bets is far too high ahead of the election outcome on May 16.

- As discussed in last analysis in Elliot wave chart of NS Nifty made an exact high of 6861. Now for Friday Range of 6895-6909 is crucial range as per Elliot wave, Crossing and sustaining the same nifty can quickly move towards 7000. Unable to cross the same we can see a dip towards 6800-6750 range.Use Fibo Circle we have given a brief range of May series in range of 6600-7225 as of now. May series promises to swing of minimum 500-600 points.

- Nifty Future May Open Interest Volume is at 1.40 cores so starting the series with lighter note.

- Total Future & Option trading volume at 3.28 lakh with total contract traded at 2.2 lakh , PCR (Put to Call Ratio) at 1.10

- 7000 Nifty CE is having highest OI at 25.5 lakhs ,initial resistance for the market with 4.8 lakh addition, 6900 CE with OI at 18 Lakhs with addition of 6.2 lakh shows ,fight will be on 6900 tomorrow, 6600-7200 CE added 15 lakh in OI.

- 6700 PE is having highest OI at 68.4 lakh with addition of 4 lakhs remains a strong support for the series, 6800 PE saw a addition of 3.4 lakhs in OI show bears again took backseat. .FII’s bought 16.5 K PE longs and 1 K PE shorts were covered taken by them.6600-7200 PE added 12.9 lakh in OI.

- FIIs bought 767 cores in Equity and DII sold 533 cores in cash segment.INR closed above 61.07

- Nifty Futures Trend Deciding level is 6895 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6895 and BNF Trend Changer Level (Positional Traders) 13234 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6861 Tgt 6881,6902 and 6925(Nifty Spot Levels)

Sell below 6840 Tgt 6820, 6800 and 6780 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Dear Sir,

Excellent analysis & thank you for accepting my request to post your views / analysis on FII activity.

Regards