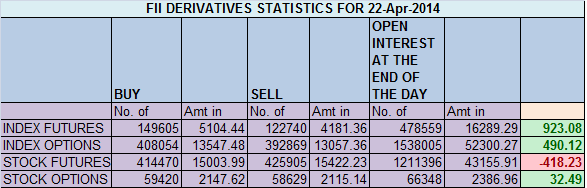

- FII’s bought 26.8 K contract of Index Futures worth 923 cores (31.1 K longs were added and 4.3 K shorts were added for Index Future) with net OI increasing by 35.4 K contracts. So today’s FII’s continue adding longs and also added fresh shorts Index Futures.

- Nifty reacted from the EW target of 6838 and did a day of consolidation by making a low of 6805 and closed well above 6800. Now looking at FII buying in Index futures we can see an impulsive up move if 6800 is not broken, 2 Possibility have been discussed as in below chart. We have expiry tomorrow so expect a volatile move in last 45 mins. Also as per time analysis we can see a impulsive move either tomorrow or on Friday.

- Nifty Future April Open Interest Volume is at 1.23 cores with liquidation of of 18.5 lakhs in Open Interest, whole 18.5 lakhs got rollovered to May series with fresh addition of 9 lakhs, OI is showing a bullish picture.Expiry -1 day the rollovers are rless as May Series OI has not crossed 1 core also suggesting FII’s are not rolling over there positions aggressively.

- Total Future & Option trading volume at 2.16 lakh with total contract traded at 1.8 lakh , PCR (Put to Call Ratio) at 1.10

- 6900 Nifty CE is having highest OI at 53.9 lakhs , resistance for the market with 7.9 lakh addition, 6850 CE with OI at 26.6 Lakhs,saw addition of 9.4 lakhs suggesting Bears want to do expiry below 6850. FII’s sold 22.1 K CE longs and 19.2 K CE shorts were covered by them.

- 6800 PE is having highest OI at 61 lakh with addition of 15 lakhs remains a strong support for the series, 6750 PE saw a addition of 1 lakhs in OI show bears again took backseat and unable to break 6800. .FII’s bought 10.3 K PE longs and 7.6 K PE shorts were covered taken by them.Do note FII’s have bought 6800 and 6900 PE in last 2-3 trading session so we can see a fall in market if 6800 gets broken.Unable to do so they will be covering there position which can see a spike up in Nifty.

- FIIs bought 162 cores in Equity and DII sold 298 cores in cash segment.INR closed above 60.76

- Nifty Futures Trend Deciding level is 6835 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6765 and BNF Trend Changer Level (Positional Traders) 12784 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6820 Tgt 6838,6861 and 6900(Nifty Spot Levels)

Sell below 6802 Tgt 6787, 6665 and 6650 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

dear mr bramesh,,what a great analysis of urs,i appreciate urs helping and giving right path to traders.from urs analysis traders can learn and convert their trading system in huge profits..great great job,god bless

Thanks Vipul !!

Rgds,

Bramesh