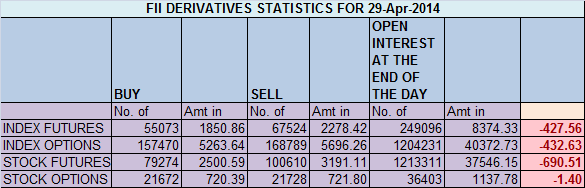

- FII’s sold 12451 contract of Index Futures worth 427cores (21.6 K longs were squared off and 9.2 K shorts were squared off for Index Future) with net OI decreasing by 30.8 K contracts. So today’s FII’s exited both long and shorts in Index future.

- Nifty closed below its 20 DMA which is bearish in short term, As per Elliot wave also as shown in below chart 6675 is on cards now. Fall today was backed by Big volumes as 6783 NF 19.42 lakh volumes were recorded suggesting bulls will only be able to sustain on a close above 6783 on NF. As per time analysis we can see a big move either tomorrow or on Friday.

- Nifty Future May Open Interest Volume is at 1.29 cores with liquidation of of 8.6 lakhs in Open Interest, suggesting bulls are liquidating the positions.

- Total Future & Option trading volume at 0.73 lakh core with total contract traded at 2.3 lakh , PCR (Put to Call Ratio) at 0.90

- 7000 Nifty CE is having highest OI at 35.9 lakhs , resistance for the market with 3.2 lakh addition, 6800 CE with OI at 27.7 Lakhs,saw addition of 3.2 lakhs suggesting writers covered there positions today suggesting possible bounceback can happen. FII’s bought 3.2 K CE longs and 19.4 K CE were shorted by them.6300-7000 CE added 7.7 lakhs.

- 6500 PE is having highest OI at 31.1 lakh with addition of 1.6 lakhs remains a strong support for the series, 6800 PE saw a addition of 1.4 lakhs in OI show smart money buying 6800 PE.FII’s bought 10.4 K PE longs and 5.6 K PE were shorted by them.6300-7000 CE added 7.8 lakhs.

- FIIs bought 288 cores in Equity and DII sold 550 cores in cash segment.INR closed above 60.42 at 1 month high.

- Nifty Futures Trend Deciding level is 6775 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6833 and BNF Trend Changer Level (Positional Traders) 13138 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6735 Tgt 6760,6780 and 6806(Nifty Spot Levels)

Sell below 6709 Tgt 6689, 6663 and 6650 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates