- FIIs bought 20503 contracts of Index Future worth 328 cores (22.7 K Long contracts were added and 2.2 K short contract were added ) with net Open Interest increasing by 25 K contracts, so FII’s added huge longs in index future and marginal shorts were added.

- Nifty finally closed above the trendline resistance, but with a formation of bearish hanging man candlestick. So low of 6287 will be very important to watch for next 2 days. Holding 6287 we can move towards all time high, Unable to do so we can correct back to 6200 odd levels. 3 Conditions should be satisfied for pattern to confirm.

- Tomorrow is going to be a red candle day.

- There is a breakdown in price tomorrow or in the next one or two trading sessions below 6287.

- 6357 is not breached on closing basis till then.

- Nifty Future March Open Interest Volume is at 1.53 cores with addition of 8.3 lakhs in Open Interest,so addition of longs.

- Total Future & Option trading volume at 1.18 lakh with total contract traded at 1.7 lakh , PCR (Put to Call Ratio) at 1.14.

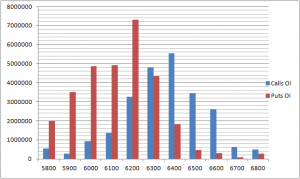

- 6400 Nifty CE is having highest OI at 55.4 lakhs , remain resistance for the series. 6200 CE saw liquidated today of 0.9 lakhs suggests weak bears panicked and liquidated,6000-6500 CE liquidated 0.25 Lakh in OI.FII’s bought 13.4 K contract of CE and 1.2 K CE were shorted .

- 6200 PE is having highest OI at 73.1 lakh with addition of 9.1 lakhs suggesting bulls wants to hold 6200, 6300 PE added 9.8 lakhs,having OI at 43.3 lakhs bulls will now protect 6300 on decline, 6000-6500 PE added 25.4 Lakh in OI .FII’s sold 1.9 K contract of PE and 24.2 K PE were shorted mostly in 6100 and 6200 PE.

- FIIs bought 737 cores in Equity and DII sold 201 cores in cash segment.INR closed at 61.74

- Nifty Futures Trend Deciding level is 6337 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6288 and BNF Trend Changer Level (Positional Traders) 10828.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Positional longs got triggered both in NF and BNF

Buy above 6336 Tgt 6347 ,6366 and 6395(Nifty Spot Levels)

Sell below 6317 Tgt 6300,6270 and 6250 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/