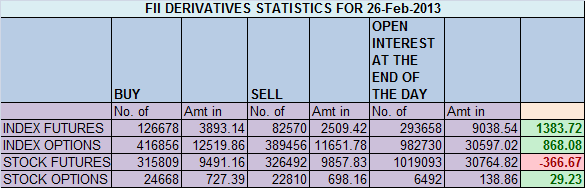

- FIIs bought 44108 contracts of Index Future worth 1384 with net Open Interest decreasing by 1.84 lakh contracts, so FII’s liquidated majority of shorts today.These are expiry numbers and should not be given much importance.

- Nifty is near its Fibo fan resistance as seen in below chart, We have Weekly and Monthly closing tomorrow, Bulls will like to close above 6281 and bear below 6197 which will decide further trend of market.

- Nifty Future March Open Interest Volume is at 1.3 cores with addition of 44 lakhs in Open Interest,SO MARCH SERIES is starting on very lighter note with 40 points premium, suggesting some premium reduction can be seen tomorrow.

- Total Future & Option trading volume at 2.62 lakh with total contract traded at 2 lakh , PCR (Put to Call Ratio) at 1.09.

- 6300 Nifty CE is having highest OI at 35.9 lakhs , remain resistance for tomorrow saw addition of 6 lakhs,6200 CE has OI of 33 lakh suggests bulls are targeting weekly close above 6200.

- 6100 PE is having highest OI at 39.4 lakh, so base at 6100 looks strong at start of series. 6200 PE added 13 lakhs,having OI at 36 lakhs, so 6200 is emerging as support. March series intital range of 6100-6300.

- FIIs bought 511 cores in Equity and DII sold 251 cores in cash segment.INR closed at 61.94.

- Nifty Futures Trend Deciding level is 6264 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6264 and BNF Trend Changer Level (Positional Traders) 10770.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6240 Tgt 6266,6280 and 6300(Nifty Spot Levels)

Sell below 6228 Tgt 6212,6200 and 6183(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/““““`