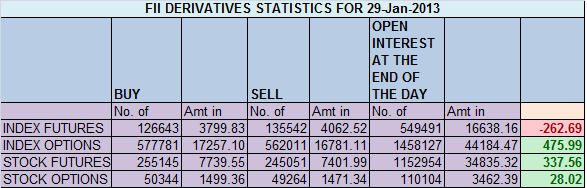

- FIIs sold 8899 contracts of Index Future worth 262 (14763 Longs were squared off and 5864 shorts were squared off) with net Open Interest decreasing by 20627 contracts, so FII’s squared off both longs and short in one session before expiry.

- January expiry will be an explosive one,SGX Nifty is trading down 84 points but all can change after FED release the statement, whether he will taper or not. Market has already factored in 10 Billion $ of taper, No taper or less will be very positive news for all Emerging Markets, PMI data from china will come tomorrow, which will be closely watched. Technically Nifty held on its 100 DMA, and was able to protect 6100 on closing basis. Nifty is forming Morning Star candle formation which is a reversal pattern but we need a confirmation tomorrow with a bullish candle.Also we are approaching the month end in 2 session, till 6106 is protected month trend is up.

- Nifty Future January Open Interest Volume is at 0.86 cores with liquidation of 21 lakhs in Open Interest,longs liquidation going and short addition, 18 lakh got rollovered on Feb series mostly shorts.

- Total Future & Option trading volume at 2.04 lakh with total contract traded at 1.9 lakh,PCR (Put to Call Ratio) at 0.98.

- 6300 Nifty CE is having highest OI at 44.3 lakhs , remain resistance for the series, 11.9Lakhs got liquidated in 6300, Is something positive coming from FED ? 6200 CE liquidated 3.1 again signalling Bulls can be back on expiry day. 6000-6500 CE liquidated 24.3 Lakh in OI.FII’s bought 10.4 K contracts of CE ,signalling expiry can be bullish.

- 6000 PE is having highest OI at 48.5 lakhs, so base moving down quickly, 6200 PE has liquidated another 4.2 lakhs, 28 lakhs in 2 days, 6100 PE is having second highest OI, so 6100 seems to be a base as of now. 6000-6500 PE liquidated 13.3 Lakh in OI.FII sold 3.2 K in PE again after today’s fall.

- FIIs bought 251 cores in Equity ,and DII sold 16 cores in cash segment.INR closed at 62.4

- Nifty Futures Trend Deciding level is 6147 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6274 and BNF Trend Changer Level (Positional Traders) 11120.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Traders who went short as per trend changer level would have made good money.

Buy above 6134 Tgt 6157,6189,6210 and 6250 (Nifty Spot Levels)

Sell below 6122 Tgt 6106,6087 and 6048 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/