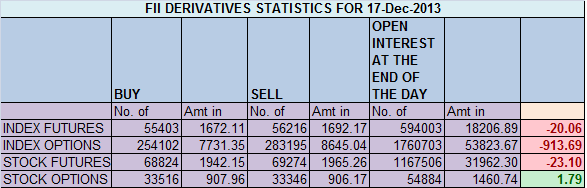

- FIIs sold 813 contracts of Index Future worth 20 cores (900 Longs contract were sold and 87 shorts contract were covered) with net Open Interest decreasing by 987 contracts, so FII’s were in no mood to carry overnight position before RBI and Fed policy.

- Nifty continued to fall for 7 straight days, falling for 327 points and closed below 50 DMA, Market is all set to make a decisive move tomorrow, after RBI policy, No rate Hike will be bullish, 25 BPS market will be down and 50 BPS fall will be sharper. For upmove to resume nifty should close and sustain above 6200.

- Nifty Future December Open Interest Volume is at 2.18 cores with liquidation of 5.9 lakhs in Open Interest,with reduction in cost of carry signalling long liquidation and short addition.

- Total Future & Option trading volume at 1.09 lakh with total contract traded at 1.7 lakh, lowest in Dec series.PCR (Put to Call Ratio) at 0.79 also signalling oversold market and bounceback on cards.

- 6300 Nifty CE is having highest OI at 70 lakhs , will remain resistance for upmove. 6200 CE added 4.3 lakh signalling call writers are having upperhand as today also NF were unable to close above 6200. 6000-6500 CE added 15.6 Lakh in OI.FII sold 3.8 K longs in CE,22.6 K calls were shorted.

- 6100 PE is having highest OI at 50.6 lakhs suggesting strong support at 6200.6200 PE liquidated 0.3 lakh in OI suggesting 6200 PE writers have not panicked looking at small liquidation eventhough NF is trading below 6200 from past 3 trading session, so bounceback can be seen in coming 6000-6500 PE added 1.7 Lakh in OI.FII’s added 161 in long PE and 2.9K PE were shorted.

- FIIs bought 249 cores in Equity ,and DII sold 97 cores in cash segment.INR closed at 62.1

- Nifty Futures Trend Deciding level is 6181 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 6261 and BNF Trend Changer Level (Positional Traders) 11541.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6154 Tgt 6183 ,6208 and 6237 (Nifty Spot Levels)

Sell below 6140 Tgt 6124 ,6106 and 6091 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

Sir,

i am interested in your pro trader course. i am from Ahmadabad(Gujarat).Please send me the details or also mode of learning .

Dear Alkesh,

I have sent you the course details. Please check you SPAM folder also.

Rgds,

Bramesh