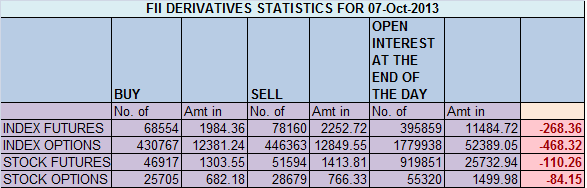

- FIIs sold 9606 contracts of Index Future (sold 23553 long contract and just 13947 shorts were covered) worth 268 cores with net Open Interest decreasing by 37500 contracts.FII’s covered there shorts at the dip but no fresh longs were entered.

- Nifty has been trading in range of 5800-5950 from past many trading sessions, baring the Fed day and RBI day both of which neutralized each other one with gap up and other with gap filling :). Nifty move went by our theory market will remain choppy with in a small range and frustrating traders and heaven for option writers. Out-performance will lie outside Index and today NSE Midcap, BSE SmallCap Indices have made a 10-week high. Running ahead of the sensex & nifty for the first time in many months. Nifty has formed an reverse hammer pattern today and closed above its 200 DMA.

- Nifty Future Oct Open Interest Volume is at 1.60 cores with liquidation of 14 lakhs in Open Interest,with falling cost of carry. Huge unwinding was seen today in Nifty Futures.

- Total Future & Option trading volume at 1.01 lakh with total contract traded at 3 lakh.PCR (Put to Call Ratio) at 0.93.

- 6100 Nifty CE is having highest OI at 46.9 lakhs with addition of 1.3 lakhs in OI, so resistance strike is moving higher. 5900 CE added 1.6 Lakhs suggesting panic in bear camp and 5800 seems to be a firm base for time being, FII’s added 22.2 K in Call option and 29.7 K CE were shorted. 5500-6100 CE added 8.8 lakh in OI.

- 5700 PE is having the highest OI of 48.7 lakhs, suggesting strong support of Nifty. 5800 PE added another 2.9 lakh suggesting 5800 can remains short term bottom for coming few days. 5900 PE added 3.1 lakh suggesting 5900 PE writers are back in action, Nifty for 3 day closed above 5900. FII’s added 2 K in Put option and 11 K PE were shorted.5500-6100 PE added 14.8 lakh in OI.

- FIIs bought 494 cores in Equity ,and DII sold 267cores in cash segment.INR closed at 61.79.

- Nifty Futures Trend Deciding level is 5902 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5896 and BNF Trend Changer Level (Positional Traders) 10055 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Nifty Future and Bank Nifty Future triggered there TSL and gave a whipsaw and are back in buy zone.

Buy above 5920 Tgt 5946, 5970 , 5992(Nifty Spot Levels)

Sell below 5900 Tgt 5875,5850 and 5835 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Hello Harish,

Ill try to answer to my best

There are two levels that are mentioned for Nifty the

Trend levels and

Chopad Levels ( posted at the beginning of week )

Trend levels for Nifty and Banknifty are based on Future price and hence you can take respective Buy/Sell based on these levels itself.

Chopad levels for Nifty and Banknifty are based on Spot price , now when you trade you would do based on any one method.

and spot price and future price there is always difference it is due to premium in future.

E.g if you are following Chopad levels and Nifty buy or sell is at 5900, you can wait for spot to reach this level and initiate buy in futures and vice versa

Hope this helps.

sir I am reading your article daily early in the morning..I m very thankful to you that you are taking this much pain for investors.sir I am new to this so want to clarify one doubt. the suggestion for stocks that you are giving is whether at spot price or future price because both are sometimes different and the suggestion for nifty you are giving is for nifty spot level than at what price of nifty future should I enter into the market because both price are different. I m little bit confused.please clarify my doubt. thanks in advance

Thanks Harsh,

Hope Vinod reply has clarified your doubts.

Rgds,

Bramesh

For some reason when you mentioned it was whipsaw and Nifty hit TSL – I felt comfortable that I am following system and what ever happened was for good…. an Intermediate beginner experience in trend levels 🙂

Thanks Vinod,

It seems easy as you have taken the training and during our back testing exercise we made sure to cover such scenarios so as to mentally prepare yourself,

Also appreciate you taking the time in answering the Harsh query.

Rgds,

Bramesh