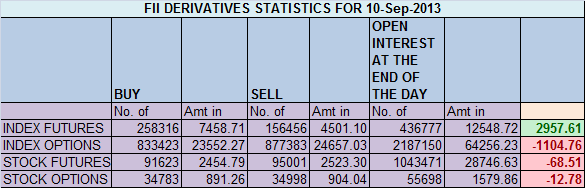

- FIIs bought 101860 contracts(Highest ever in single day) of Index Future (Bought 87098 long contract and 14762 shorts were liquidated) worth 2957 cores with net Open Interest increasing by 72336 contracts.The spectacular rally we saw today many reasons can be given the most important reason was FII have covered there most of shorts on Friday session as discussed yesterday and analyzing my data sheet most of these shorts were covered in loss, Now FII’s have money power and global environment was conducive with bearishness on the street was recipe for the rally. Buying 1 Lakh contract in single sessions double of what they shorted recovered all there losses and are back in profit :).

- Nifty rose the highest in 4 years just shy of 5900 rallies 555 points in 4 days and Sensex closed above the psychological level of 20K. Nifty in single session has conquered the 50/100 and 200 DMA giving an impulsive rally. As discussed in weekly analysis. September is one of the most bullish month for Indian market and History repeats again :). How far the rally can last, Traders holding long watch out for close above 5946. Closing above 5946 Nifty can rally further till 5995 and 6077, Unable to close above 5946 pullback till 200 DMA can be seen. I am happy for few students who have participated in whole rally returned back to profit and more importantly got their trading confidence back and understood the fact retailers can also make money in Stock market :).

- Nifty Future Sep Open Interest Volume is at 2 0cores with addition of 20.4 lakhs in Open Interest, so longs are getting back to system with rise in cost of carry.

- Total Future & Option trading volume at 1.84 lakh with total contract traded at 5.2 lakh Cash volume is also higher from past 2 days suggesting delivery based buying ,PCR (Put to Call Ratio) at 1.03. VIX consolidating in range of 28-31 for time being.

- 6000 Nifty CE is having highest OI at 39 lakhs with addition of 7.9 lakhs in OI will be short term resistance. 5500-5800 CE liquidated 23 lakh in OI suggesting panic in bear camp.As per FII analysis,34.5 K long were entered in Calls, 17.7 K contract were written. 5500-6000 CE liquidated 13 lakh in OI.

- 5600/5700 and 5800 PE together added 57 lakh in OI, suggesting strong support of Nifty at lower levels.5900 PE has seen some buying suggesting small intraday pullback can be seen . As per FII data added 29.6 K contract of PE and wrote 90.3 K contract FII options data analysis shows a bullish picture with Huge PE writing and Call Buying.5500-6000 PE added huge 78 lakh in OI.

- FIIs bought in Equity in tune of 2563 cores ,and DII sold 1398 cores in cash segment.INR closed at 63.84 so our analysis of Has Indian Rupee made Short term Top, Weekly Analysis

- Nifty Futures Trend Deciding level is 5854 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5553 and BNF Trend Changer Level (Positional Traders) 9316.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Traders following TC level on NF and BNF should made a killing with profit of 800 points in BN and 350+ points in NF.

Buy above 5905 Tgt 5925 ,5946 and 5988 (Nifty Spot Levels)

Sell below 5881 Tgt 5866, 5842 and 5820 (Nifty Spot Levels)

I have been getting lots of mail to share performance of positional calls based on new trading course we have launched , Readers can see the performance http://positionalcallsperformance.blogspot.in/

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863

This is nothing but manipulation of the market.

Puts have been sold and the calls bought. Furthermore DIs shorted in the beginning and the FIIs have bought at the fag end to boost the market.