- FIIs bought 708 contracts of Index Future (Book profits in 2421 Contracts of shorts and 1713 fresh longs were sold) worth 37 cores with net Open Interest decreasing by 4134 contracts. So as per data analysis, FII are exiting longs and booking profits in shorts. Golden Rules for Traders trading based on Chart/ Chart Pattern

- Nifty opened gap up after Fed indicated no tapering in near future, but the sentiment were soiled by FT defaulting on payment of NSEL . Read more about Crash in FT. Nifty continued with its downtrend, falling for 7 consecutive day,Nifty has formed a double bottom pattern today, which is bullish pattern and we need a follow upmove above 5800 to confirm the same. As discussed in Weekly analysis Nifty Spot till it trades below 5900 bears will be in power and today we completed all the weekly targets :).

- Nifty Future Aug Open Interest Volume is at 1.64 cores with liquidation of 2.8 lakhs in Open Interest, shorts booking profit with fall in Cost of Carry.

- Total Future & Option trading volume at 1.57 lakh with total contract traded at 3.6 lakh , PCR (Put to Call Ratio) at 1.07.VIX is again approaching the breakout above 20.

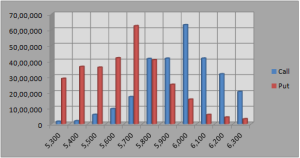

- 6000 Nifty CE is having highest OI at 63 lakhs with addition of 3.9 lakhs in OI, is wall of resistance. 5900 CE added 4.9 lakh in OI and having second highest OI at 41 lakh,5800 CE adding 10 lakh in OI suggests suggests long addition in 5800 CE and we can see some decent upmove. As per Option data OI analysis FII have entered long in Calls and exited in written puts suggesting relief rally on cards. 5600-6200 CE added 25.8 lakh in OI.

- 5700 PE OI at 62.4 lakh remain the highest OI, with addition of 3 lakh in OI, today bulls were able to protect 5700 on closing basis so 5700 PE writers were able to hold on today, 5600 PE added 1.2 lakh in OI and smart money exiting Puts options and booking profit, so indication of relief rally. 5600-6200 PE added 6.1 lakh in OI.

- FIIs bought in Equity in tune of 177 cores ,and DII sold 293 cores in cash segment ,INR closed at 60.64

- Nifty Futures Trend Deciding level is 5778 (For Intraday Traders).Nifty Trend Changer Level 5865 and Bank Nifty Trend Changer level 10406.

Buy above 5740 Tgt 5765,5795 and 5820(Nifty Spot Levels)

Sell below 5720 Tgt 5700,5675 and 5650(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

On daily charts Nifty is forming a bulling symmetric triangle (like).

By today as you pointed out it formed a double bottom pattern which is again bullish.

Also in Monthly charts, Nifty is showing a Ascending triangle pattern. Most probable target for the Nifty in the coming 2 years is 10000. First confirmation is Nifty should cross 6300 by September this year.

Knowing this bullishness, i am really struggling to think which sector will play a key role for the Nifty to take it up to 10000?

Dear Hari,

I try to trade for smaller targets instead of forecasting big targets which are not tradeable, For investment you need to see the Fundamentals of the company you are investing, Fundamental are robust price will catch up.

Rgds,

Bramesh