RBI Monetary Policy 17th June 2013 Expectaton

CRR (Exp 4.0%, Prior 4.0%)

Repo (Exp 7.25%, Prior 7.25%)

Reverse Repo Rate (Exp 6.25%, Prior 6.25%)

RBI governor has given hint Inflation is still high, cutting hope of rate cut putting pressure on Bank Nifty further. So lets discuss how to trade Bank Nifty in coming week as its an expiry week.

Equity market will react positive to the 25bps . In absence of any positive announcement sell off can be seen and Nifty can drift down to 5700 levels…

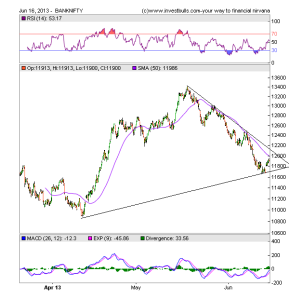

Bank Nifty Hourly

Bank Nifty is trading below resistance of 50 HSMA, Any pullback is above 50 HSMA only.Hourly chart are also forming an Symmetrical triangle pattern as shown in above chart.

Bank Nifty Daily

Bank Nifty after taking resistance at upper end of channel corrected and is now trading near the lower end of channel and also near its 200 DMA.

Bank Nifty Fibo Fans

Fibo Fans has been applied on Bank Nifty weekly charts unable to sustain the 3 channel for fibo channel and start giving pullback , Support is at 11426

Bank Nifty Fibo Retracement

As per Fibo theory 11845 is 61.8% retracement of 13420-10872.Breaking of 11845 further slide till 11000 can be seen next week.

Bank Nifty Weekly

Bank Nifty on WoW basis was down by 309 points and closed below 12000 . Unable to close above weekly rising trendline at 12300 in coming week will put further pressure on Bank Nifty

KST has also given a SELL as per Bank Nifty Weekly charts.

Bank Nifty Monthly

Monthly charts are approaching the long term trendline and was unable to cross and formed a DOJI Candelstick pattern signalling reversal.

Bank Nifty Trading Levels

Bank Nifty Trend Deciding Level:11990

Bank Nifty Resistance:12160,12300 and 12450

Bank Nifty Support:11800,11600 and 11450

Levels mentioned are Bank Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863