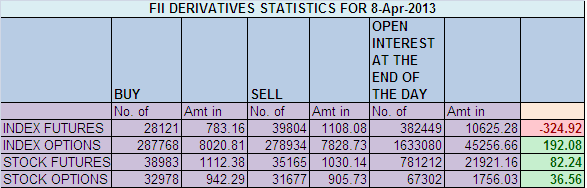

- FIIs sold 11683 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 325 cores with net Open Interest increasing by 12269 contracts. FII added more shorts in Index Futures as net OI rose with price. How to manage Commodities Trading Account .

- Nifty has fallen 218 points in matter 5 trading days is going in sideways mode in past 2 days. As discussed in Weekly Analysis, 5535 is an important support as its both 233 DMA and double bottom also. Today Nifty made low of 5537 and closed above it. But closing was the lowest closing in past 6 months which is not good sign for Bulls. Today we have again formed an NR7 day which means big range day coming tommrow, so prepare yourself accordingly. Again,would request readers please do not speculate on Bottom of Nifty and think of going long thinking market cannot fall below this, We do not control market, Market control us. Get Used to This fact and do not go for adventurous longs till we get confirmation.

- Nifty Future March Open Interest Volume is at 1.71 cores with addition of 5.4 lakh in Open Interest with increase in Cost of Carry of Nifty Future to showing traders have short positions .

- Total Future & Option trading volume at 0.77 lakh Cores with total contract traded at new 52 week low 1.31 lakh , Cash market volumes were below avearge , suggesting no delivery based selling has started. PCR (Put to Call Ratio) at 0.90 and VIX at 16.77

- 5700 Nifty CE is having highest OI at 87.1 Lakh with addition of 6.6 Lakhs, so 5700 remains key resistance.5600 CE also added 4.9 lakhs in OI with net OI at 54.7 lakhs, 5400-6000 CE added huge 19.9 Lakhs in OI

- 5500 Put Option is having highest Open Interest of 56.7 lakhs with addition of 3.1 lakhs in OI, 5600 PE liquidated 2.96 lakhs and net OI at 55 lakhs, Such Low OI in PE suggests the hesitation of market participants to write puts, low base OI also means pullback will be limited and correction is still not over .5400-6000 PE added just 0.16 Lakhs in OI

- FIIs sold in Equity in tune of 164 cores,FII net sold 794 cores in April Series and DII bought 213 ,INR closed at 54.56 Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 5556 (For Intraday Traders). Nifty Trend Changer Level 5662, Bank Nifty Trend Changer Level 11321. Shorts are still active Nifty and Bank Nifty, almost 150 points gain in Nifty and 300 Points in BN partial profit booking is advisable.

Buy above 5550 Tgt 5562, 5580,5600(Nifty Spot Levels)

Sell below 5525 Tgt 5500,5474 and 5546(Nifty Spot Levels)

Traders who want to track MCX rate live and do not have access to ODIN can use this site http://

freemcxdata.blogspot.com/ Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Looking at the options data, all roads are leading to the gap filling of 5526 to 5486