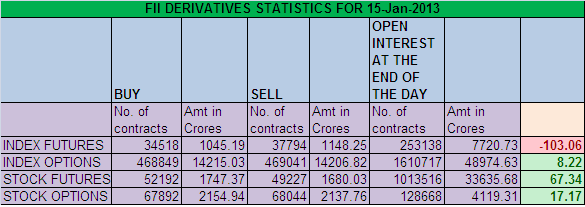

1. FIIs sold 3276 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 103.06 cores with net Open Interest decreasing by 9254 contracts.

2. As CNX Nifty Future was up by 23 points with Open Interest in Index Futures decreasing by 9025, so FIIs booked out longs in Nifty and Bank Nifty Futures. Sensex briefly hit the sacrosanct level of 20000 and Nifty moved above 6050 but FII’s are using these as an opportunity to exit out of longs. Sounds Interesting !!

3. NS closed at 6057 after making high of 6069 and low of 6019 . As discussed yesterday analysis Dips near 6000 should be bought into and we got a nice intraday trade during afternoon session. The lower volumes as compared to the last five sessions have accompanied previous two sessions upmove while Nifty moving into a new high area, which is suggesting lack of participation at higher levels.Nifty has comfortably closed above 6050 and now only trendline resistance which remains is 6065-6070 range.

4. Resistance for Nifty has come up to 6070 and 6098 which needs to be watched closely ,Support now exists at 6048 and 6027 .Trend is Buy on Dips till 5951 is not broken on closing basis.

5. Nifty Future January Open Interest Volume is at 1.55 cores with liquidation of 4.3 lakh in Open Interest, shorts unwounded.Cost of Carry of Nifty Future reduced to 9.98 with fall in OI suggesting short liquidation.Market participants are holding nifty well with sector rotation, One day its IT today it was telecom and cement which held Nifty.

6. Total Future & Option trading volume at 1.27 lakh Cores with total contract traded at 1.83 lakh, PCR (Put to Call Ratio) at 0.89 and VIX at 13.58.Cash market turnover was highest in Jan series today which shows buying required to break 6050.

7. 6200 Call Option is having highest Open Interest of 84.5 lakhs with liquidation of 3.9 lakhs in Open Interest, 6100 Nifty CE is having second highest OI at 60.7 lakh also saw liquidation of 8.9 lakhs in OI,with Option premium at Rs 50 shorts covering and fresh buying again seen in 6100 CE,6000 CE saw liquidation of 3.4 lakhs in OI suggesting bulls routed bears showed them who is the BOSS for time being 🙂 .5700-6300 Call Options liquidated 10 lakhs in OI.

8. 5900 Put Option is having Open Interest of 81.8 lakhs with addition of .3 lakhs in OI so firm base is set up at 5900 and 6000 Put Option added 13 lakhs with OI at 69 Lakhs so 6000 is coming as the base for time being and dips near 6000 should be bought into.5700-6300 Put Options added 8.3 lakhs in OI.

9. FIIs buying in Equity in tune of 1077 cores and DII sold 755 cores in cash segment,INR closed at 54.46 Live INR rate @ http://inrliverate.blogspot.in/).

10. Nifty Futures Trend Deciding level is 6100(For Intraday Traders), Trend Changer at 6009 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 12762.

Buy above 6069 Tgt 6080,6098and 6120

Sell below 6045Tgt 6027,6019,5999(Nifty Spot Levels)

Traders who use Pivot and Camarilla can use the follwing 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

Expiry close should be around 5980 as market gives deep pain to large number of players who are positioned at 6000 call 5900 put with margin of 100 so market tries to close at centre of this lap.