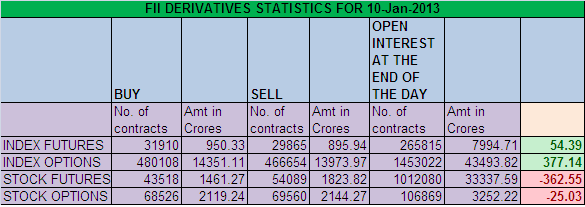

1. FIIs bought 2045 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 54.39 cores with net Open Interest increasing by 15325 contracts.Do you think we are in Bubble? Read this to get more insight How to survive stock market bubble http://bit.ly/XQgXOJ

2. As CNX Nifty Future was up by 4.8 points with Open Interest in Index Futures increasing by 15325, so FIIs booked out shorts in Nifty and Bank Nifty Futures. As the average Buy rate comes as an weird number of 5319 suggesting intraday trades taken by FII. Two important data coming out tommrow IIP data around 11 AM and Infosys results before market opens so tommrow expect some volatility in market.We have interesting Poll going on our FaceBook Page Bramesh tech (Click on Link)

regarding Infosys opening. Please feel free to participate and post your views.

3. NS closed at 5968 after making high of 6005 (Almost near to our resistance level of 6008 as discussed yesterday) and low of 5947 .At last today the gap of 5951 got filled as discussed yesterday would not be surprised to see Nifty come down and fill the gap completely. Hope no one was stuck in morning gap up. This is power of gap theory which we cover in our trading course.

4. Resistance for Nifty has come up to 5978 and 6005 which needs to be watched closely ,Support now exists at 5947 and 5930 .Trend is Buy on Dips till 5920 is not broken on closing basis.

5. Nifty Future January Open Interest Volume is at 1.61 cores with addition of 6.0 lakh in Open Interest,longs got added and shorts unwounded.Cost of Carry of Nifty Future increased to 8.24 with rise in OI suggesting long addition.Now there are 2 things which concerns me 1) With 50 points fall in Nifty traders are getting panicked and using superlative words like crash,bloodbath 2) The way dips are getting bought making traders complacent of higher target on Nifty. Today NS has closed in red but premium increased suggesting high level of confidence in traders which should be watched with caution.Every Analyst in Blue channel is positive on market.

6. Total Future & Option trading volume at 1.12 lakh Cores with total contract traded at 1.68 lakh, PCR (Put to Call Ratio) at 0.94 and VIX at 13.27.

7. 6200 Call Option is having highest Open Interest of 80 lakhs with liquidation of 3.8 lakhs in Open Interest, 6100 Nifty CE is having second highest OI at 62.4 lakh also saw addition of 1.4 lakhs in OI,with Option premium at Rs 30 shorts were again added in 6100 CE,6000 CE added 2.6 lakhs in OI suggesting bears are gaining strength at 6000 levels .5700-6300 Call Options liquidated 6.6 lakhs in OI.

8. 5800 Put Option is having Open Interest of 76 lakhs with addition of 4.5 lakhs in OI so firm base is set up at 5800 and 5900 Put Option added 2.2 lakhs with OI at 68 Lakhs,6000 PE liquidated 0.5 lakhs in OI suggesting bulls again lost the battle of 6000 .5700-6300 Put Options added 12.2 lakhs in OI. Now as today FII were net buyer of 377 cores in Index options so smart money is buying deep OTM puts.

9. FIIs buying in Equity in tune of 249 cores and DII sold 433 cores in cash segment,INR closed at 54.77 Live INR rate @ http://inrliverate.blogspot.in/).

10. Nifty Futures Trend Deciding level is 6015(For Intraday Traders), Trend Changer at 6003 NF(For Positional Traders). (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand). Bank Nifty Future Trend Changer Level 12749.

Buy above 5985 Tgt 6008,6018,6030and 6045

Sell below 5947 Tgt 5937,5920,5885(Nifty Spot Levels)

Traders who use Pivot and Camarilla can use the follwing 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

Hi Bramesh,

At the 3 point you have mentioned resistance level of 6088 as yesterday’s discussed level its 6008 mistakenly typed

Thanks Athiji

Number corrected..

Rgds,