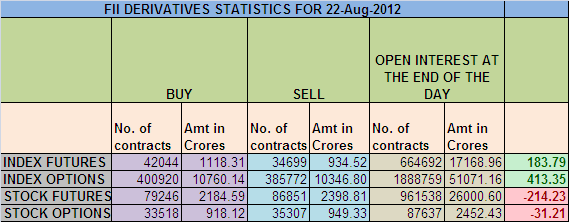

1. FII bought 7345 Contracts of NF ,worth 183 cores with net OI decreasing by 3965 contracts.

2. As Nifty Future was down by 11 points and OI has decreased by 3965 , FII have started booking profits Index futures. The way we fell down from 5455 NF suggests profit booking.

3. NS closed at 5413 after making the high of 5433. Bulls successfully manged to close nifty above 5400 inspite of bad global cues which suggests strength.Resistance for Nifty has come up to 5446 and 5467 which needs to be watched closely ,Support now exists at 5395 and 5366 .Trend is still buy on Dips till 5269 is not broken on closing basis.

4. As we discussed yesterday it will be a range bound day and a listless market and nifty obliged us by doing nothing. We were also able to capture the top end of of NF with our daily morning range updated on Facebook page which comes at 5405-5455. Hope traders were able to benefit the same.

5. Nifty August OI is at 2.61 cores with an unwinding of 2.57 Lakh in OI, longs were unwounded by Retailers and HNI. I expect small range tomorrow probably till 5447 on higher end and 5400 on lower end with stock specific action looking at OI figure.(This is what we discussed yesterday and same happened today).

6. Total F&O turnover was 1.06 lakh Cores with total contract traded at 1.68 lakh,Nifty Future made a new high with pathetic volumes,Also the Cash volume were 30% lower than average which suggests distribution happening at higher levels.Be cautious on your longs and ride it till music lasts.

7. 5300 CE also saw an unwinding of 1.67 lakhs with total OI now standing at 31 lakhs,Call Writers ran for cover. 5400 CE saw an unwinding of 0.44 lakhs and total OI stands at 65 lakhs no major unwinding seen, 5500 CE still having highest OI of 1 core lakhs,with fresh addition of 1.6 lakhs in OI.

8. 5300 PE added 0.8 lakh in OI and having the OI at 1.07 cr which suggests traders are getting confident that 5300 will not break in August Expiry.5400 PE also added 10 Lakh in OI so now traders are eyeing 5400 PE as next base for Nifty.

9.FII bought 96 cores and DII sold 230 cores in cash segment.INR closed at 55.57 Live INR rate @ http://inrliverate.blogspot.in/).FII again sold 230 cores in Stock Futures.

10. Nifty Futures Trend Deciding level is 5386, Trend Changer at 5312 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy above 5433 Tgt 5447,5467 and 5500

Sell below 5414 Tgt 5395,5366 and 5350 (Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

DEAR SIR

IAM INTERESTED IN YOUR DERIVATIVE ANALYSIS. PLEASE SEND DAILY REPRTS

TO MY MAIL ID.

THANKING U SIR

IV PHANIKUMAR