We have 4 important event tomorrow :

1. Infosys results before market opens (Infosys Technically explained)

2. IIP data at 11 AM

3. WPI data expected to be highest in recent times

4. TCS Results after market closes around 6 PM

So its an eventful day and as Infy and TCS has combined weightage of 12% so it will definatley affect Nifty and set the tone for IT sector.

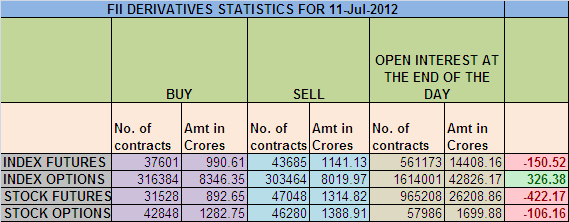

1. FII sold 6084 Contracts of NF ,worth 150 cores with net OI increasing by 2746 contracts.

2. As Nifty Future was down by 35 points and OI has increased by 2746 contracts means FII have booked profits in longs and initiated fresh shorts in Index futures.

3. Nifty made a fresh July high today at 5349 and sentiment is overtly bullish with calls of 5500-5600 on cards. If one see the Daily charts closely 5342-5378 is the range of supply,Risk traders can take fresh shorts in this range with Sl of 5380. This is what we discussed yesterday and today Nifty made a high of 5336 and turned back.

4. Support for Nifty has come up to 5290 which needs to be watched closely tomorrow,Nifty also has a gap of 9 points which needs to be filled from 5336-5345,VIX jumped up 3% today with ATR coming below 70 which goes by our observation july being a month of consolidation. Breakout comes above 5380 and Breakdown below 5260. Market participants should be happy with small gains as this is need of hour.

5. Nifty June OI is at 2.32 cores with an fresh liquidation of 2.3 lakhs in OI, longs were liquidated.

6. Total F&O turnover was 0.87 lakh Cores with total contract traded at 1.92lakh, so we had the lowest number of contract traded in 2012 which suggests lack of trading participation. Explosive moves are round the corner.

7. 5300 CE saw an addition of 1.74 lakhs and total OI stands at 59 lakhs and 5400 CE has the highest OI at 79 lakhs. So 5400 is upper ceiling.

8. On Put side 5000 PE is having highest OI of 80 lakhs with 1 lakhs addition meaning 5000 is current base for market,Liquidation of 6 lakhs was seen in 5200-5300 PE .5200 is the immediate support for market based on Options data.

9.FII bought 84cores and DII sold 356 cores in cash segment. INR closed at 55.65 Live INR rate @ http://inrliverate.blogspot.in/)

10. Nifty Futures Trend Deciding level is 5135, Trend Changer at 5314 NF (Above this Level Bulls will rule Nifty/Below this levels Bears have upper hand).

Buy above 5314 Tgt 5378,5400 and 5420

Sell below 5290 Tgt 5268 5236 and 5217 (Nifty Spot Levels)

Disclaimer: These are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

You can register your email address under Post In your Inbox(Right Side Column) if you want to receive mail instantaneously as soon as site get updated. You will receive a confirmation mail in your registered email address you need to click on link to get it confirmed.

RESP SIR.

GOOD DAY SIR, YOUR ANALYSIS REALLY HATS OFF. SOME TIME IT LOOKS DRAMATIC BUT AT END OF DAY, WEEK, SERIES IT’S HAPPEN. THANKS FOR YOUR VALUABLE RESEARCH & EFFORTS FOR TRADER AND INVESTER LIKE ME.THANKS A LOT. KEEP ROCKING………….

GR8 ……..BYE.

Thanks a lot sir..

Rgds,

Bramesh