Bombay Dyeing

Bombay dyeing has been respecting its upward and downward channel as shown in the chart. Break on above the trendline can add further rally to the stock.

Mometum indicator are in overbought zone and Rise in stock is accompanied with expansion in volume which is healthy for stock

Mometum indicator are in overbought zone and Rise in stock is accompanied with expansion in volume which is healthy for stock

Buy above 375 Tgt 379 and 384

BHARTI AIRTEL

Bharti Airtel has been trading in traingle channel respecting both its up trending line and down trending line.

Stock moves in trading range of 375-385 which can be used for scalp trading in short term.Break of either side again will give good upmove /dowm move of 5-7%.

Buy above 379.4 Tgt 381.9,383.3 and 385

Sell below 375 Tgt 372.3 and 369.1

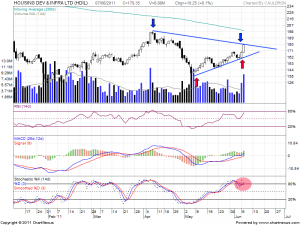

HDIL

HDIL has been rising on a lower trend line and getting resistance at upper trendline. Stock has risen with volumes and if unable to break 181 it is an ideal candidate for shorting.

HDIL has been rising on a lower trend line and getting resistance at upper trendline. Stock has risen with volumes and if unable to break 181 it is an ideal candidate for shorting.

Upper Trendline resistance @181 needs to be watch out for todays trending session.

Stochastic is in overbought zone adding confirmation to our short trade.

Sell at 181 Tgt 176,173 and 171

Buy above 185 Tgt 188,192 and 199(200 DMA)