Last Week we gave Chopad level of 10890 Nifty gave a Short trade on Monday did all 1 target on downside and Long on Tuesday hit SL Short did 3 Target on downside , so EXCELLENT week for Chopad Followers. Lets see how we trade Nifty in coming week as we approach time cycle date of 08 Jan.

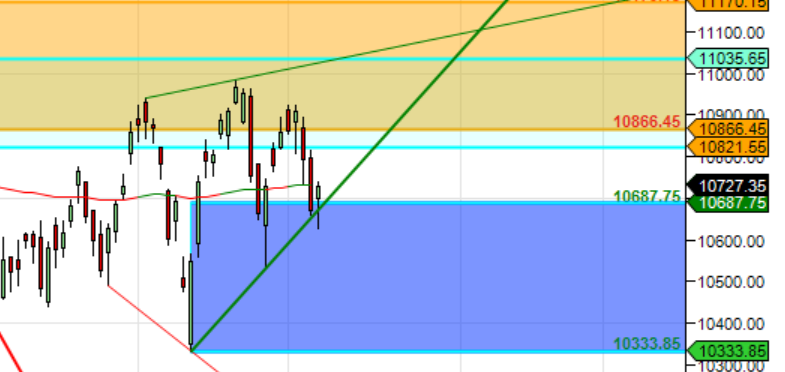

Nifty Harmonic

Till we are holding 10600 we can scale towards 11000/11250/11318,Low made last week was 10628 and bounced back.

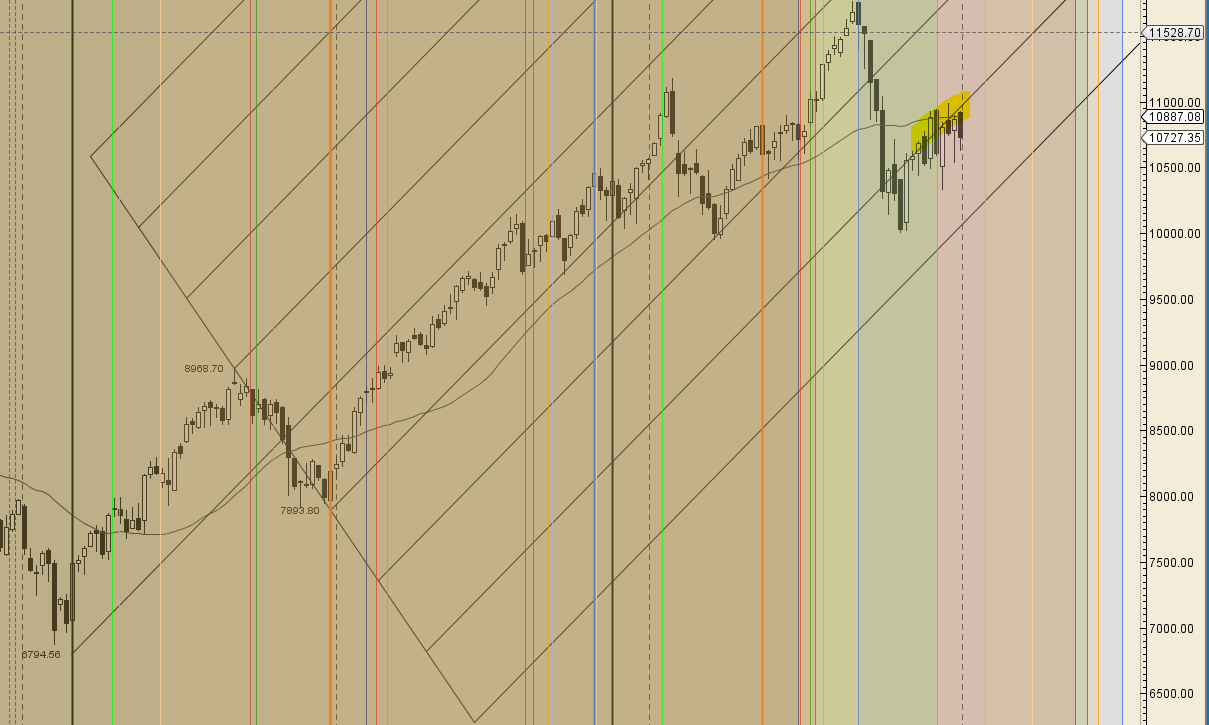

Nifty Gann Angles

Trading near support zone

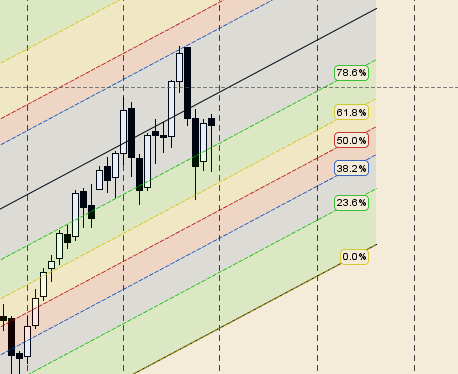

Planetary Cycles and Nifty Movements

Bulls need to trade above 10816 for a move towards 10890/10940/11100. Bearish below 10730 for a move back to 10666/10610

Nifty Supply and Demand

Self Explanatory chart..

Nifty Time Analysis Pressure Dates

Nifty As per time analysis 08 Jan is Pressure date , impulsive move can be seen around these dates.

Nifty Weekly Chart

It was negative week, with the Nifty down by 132 points closing @10727.As discussed in Last Analysis Bulls need to trade above 10890 for a move towards 10940/11030/11090. Bearish below 10800 for a move back to 10730/10666/10610

Bearish target done, Now Bulls need to close above 10816 for a move back to 10882/10933/10985. Bearish below 10730 for a move back to 10666/10610/10570/10512

Trading Monthly charts

Nifty Bulls need to close above 10881 in January month for the Monthly chart to turn bullish.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:10816

Nifty Resistance:10881,10941,11030

Nifty Support:10760,10700,10636

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh