- FII’s sold 20.3 K contract of Index Future worth 1610 cores ,712 Long contract were added by FII’s and 21 K Short contracts were added by FII’s. Net Open Interest increased by 21.7 K contract, so fall in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 0.57. Understanding Stock Market Crash

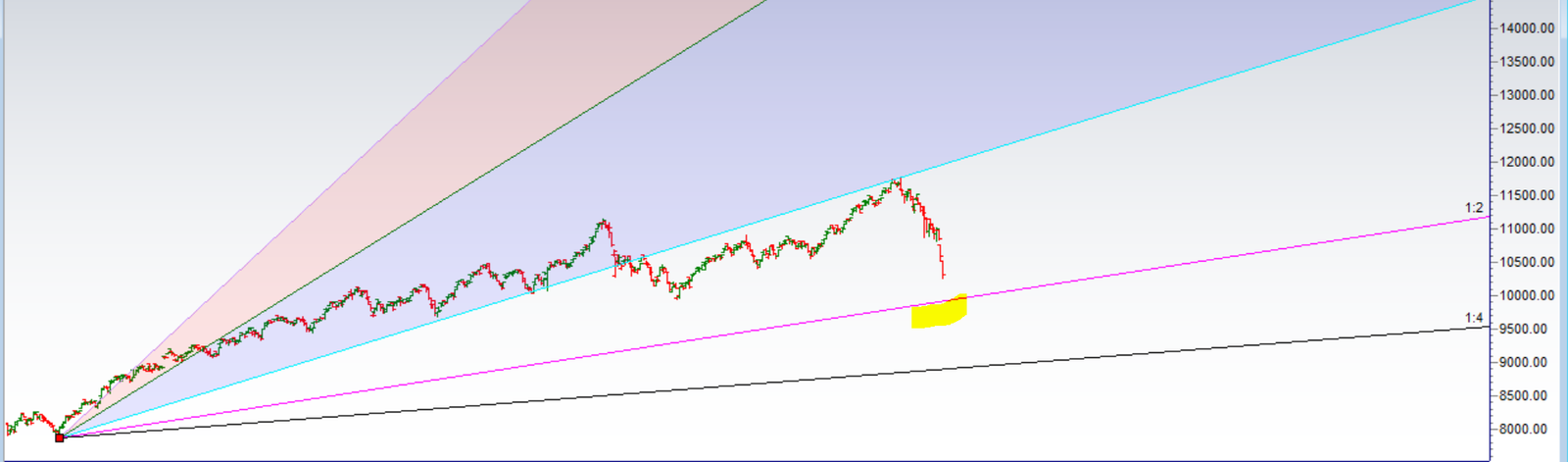

- As Discussed in Last Analysis Nifty opened gap down so traders who were short from 10944 were rewarded and below are the intraday levels we posted on FB and Twitter Nifty moved as per analysis. Today we will hit 10512/10455 in opening. Now Bears need to make sure we do not close above 10570 for down move to continue towards 10410/10355/10210. Bullish above 10570 for a move towards 10610/10666/10730. 10455 done in opening and shared the below message during market hours hope it helped traders as we even hit 10270, Its been a one way decline and we were on the right side of trend, its does not matter if u missed part of the move whats most important is not losing money. Now we are looking for another gap down open on Monday, 10210 will act as last support if broken we are heading towards 10090/9953/9800 as per gann chart shown below, 9800 is important level as there we will see price time squaring happening if it come before 14 Oct. Bullish only on close aboe 10410 for a move back to 10466/10510/10570.Important intraday time for reversal can be at 9:15/1:25. Bank Nifty crashes after RBI Policy,EOD Analysis

- Nifty Oct Future Open Interest Volume is at 2.01 core with addition of 15.7 Lakh with decrease in cost of carry suggesting Short position were added today, NF Rollover cost @11075 closed below it.

- 10800 CE is having Highest OI at 28.6 Lakh, resistance at 10500 followed by 10650 .10200-11000 CE added 65 lakh in OI so bears added position in range of 10500-10600. FII bought 18.5 K CE and 31.3 K CE were shorted by them. Retail bought 118 K CE and 59.9 K CE were shorted by them.

- 10000 PE OI@24.7 Lakhs having the highest OI strong support at 10000 followed by 10100 . 10000-10500 PE liquidated 4.1 Lakh in OI so bulls covered position in range 10300-10500 PE. FII bought 45.3 K PE and 15.4 K PE were shorted by them. Retail bought 9.7 K PE and 17.4 K PE were shorted by them.

- Total Future & Option trading volume at1 7.69 Lakh core with total contract traded at 2.6 lakh , PCR @0.68

- FII’s sold 3370 cores and DII’s bought 1902 cores in cash segment.INR closed at 73.57, Indian Rupee nearing a Short term top

- Nifty Futures Trend Deciding level is 11463 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10856. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10220 Tgt 10250,10270 and 10325 (Nifty Spot Levels)

Sell below 10199 Tgt 10170,10130 and 10090 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Good anyalist sir I request u sir list of A group which is down and buy for long term for best portfolio