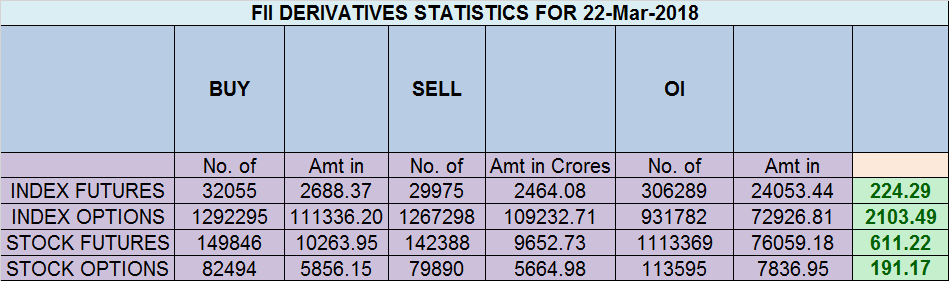

- FII’s bought 2 K contract of Index Future worth 224 cores ,4.5 K Long contract were added by FII’s and 2.4 K Short contracts were added by FII’s. Net Open Interest increased by 6.9 K contract, so fall in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 0.70 .Why Do Traders Overtrade?

- As Discussed in Last Analysis Nifty opened with gap up did high of 10227 near our target of 10230,and close above 10155. Bulls till holding 10155 on closing basis can see rally towards 10230/10300/10410. Bearish below 10050 for a move towards 10000/9920. Bulls failed to close above 10155, Now we are in no trade zone between 10155-10050. Break of any side will give a move of 100-150 points easily. Bullish above 10155 for a move towards 10155 for a move towards 10220/10300. Bearish below 10050 for a move towards 10000/9936. As seen in below chart, prices have been respecting gann angles Important intraday time for reversal can be at 11:45/2:35. Bank Nifty bulls holding 24250,EOD Analysis

- Nifty March Future Open Interest Volume is at 2.28 core with liquidation of 0.75 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @10395 closed below it.

- Total Future & Option trading volume at 13.65 Lakh core with total contract traded at 1.67 lakh , PCR @0.84

- 10500 CE is having Highest OI at 62.8 Lakh, resistance at 10300 followed by 10400 .10000-10600 CE added 20 lakh in OI so bears added position in range of 10400-10300. FII sold 1.8 K CE and 2.5 K shorted CE were covered by them. Retail sold 65 K CE and 64 K shorted CE were covered by them.

- 10000 PE OI@58.8 lakhs having the highest OI strong support at 10100 followed by 10000 . 10000-10500 PE added 2 Lakh in OI so bulls added major position in 10000-10100 PE. FII bought 4.6 K PE and 11.8 K PE were shorted by them. Retail sold 46.5 K PE and 36 K shorted PE were covered by them.

- FII’s bought 161 cores and DII’s bought 409 cores in cash segment.INR closed at 65.10

- Nifty Futures Trend Deciding level is 10114 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10176 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10120 Tgt 10140,10155 and 10180 (Nifty Spot Levels)

Sell below 10075 Tgt 10040,10020 and 9980 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Looks like Mr.Ddawra in deep trouble. Hang in there buddy. Its market. By nature its random. People do get swayed away in the flow of it sometimes. You will recover soon.

FYI, there is no mention of the word “dow” in the entire analysis and even if somebody follows dow & analyse based on that, that sound perfectly sensible to me.

Thanks !!

Should be ” who have none” in the last line.

Hahhaahhahaha….ddawra! What happened brother? I lost 23k due to overnight positions on suntv by following own thing. Cool, the world outside is pure cannibalistic. Here you have someone like my Master, who does it all just for the pure love of the game. I’m fortunate that I follow someone who knows exactly what he is doing and has good volition to share it with those who don’t have none. Appreciate!

Dear Sir,

You again lost money, this is not good. Call me in evening today lets have a brief discussion on your trading..

Mr.ddawara can you suggest any web sight suggesting daily 3 shares & its results performance freely.Most of them say 100% success and they dont say it is a probability game.Finding fault is easy.It is a known fact every thing depends on US economy

Thanks.. We also closed below 10155

Ddawra ,could you please put some of your product , that is not crap ! If you are already in production please inform where it is available .

Ignore the noises !! 🙂

Nothing wrong in following DOW. Only result matters. I am hugely benefited by following his views.

thanks a lot sir !!

Most of your analysis is based on dow performance … you look at Dow and then update your blog citing it as technical analysis… crap

Thank you for your comments.. Hope you are feeling better after venting your frustration. Most imp thing in trading is being accountable to “ourself”. Finding fault in other is easy but finding fault within yourself is most difficult task.