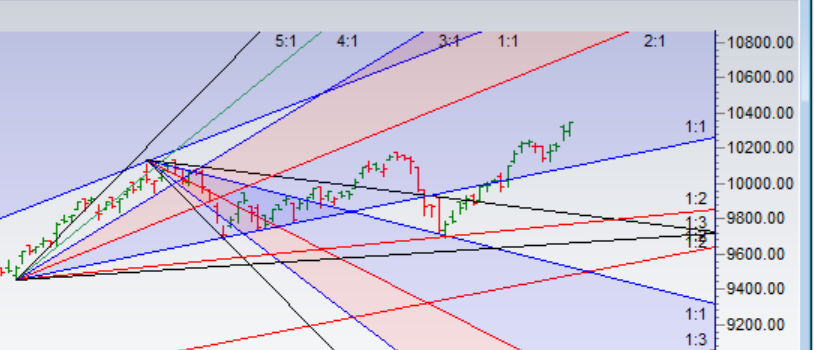

- As discussed in last analysis Low made today was 10241 and High made was 10341 s0 nifty moved in our range of 10250 towards 10341 near our target of 10355. Now Bulls need to hold 10250 on closing basis for next move towards 10400/10521/10575. Bearish below 10240 for a move towards 10140/10090. High made today was 10355 exactly our target as we have been discussing. Thats the beauty of Gann Analysis:) Close above 10355 we are heading towards 10410/10471/10600.Bearish below 10240 for a move towards 10140/10090.As per time analysis 27 Oct is another important trend change date for Nifty Bank Nifty November Series Overview

- Nifty Nov Future Open Interest Volume is at 2.23 core with addition of 9.2 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @10280 with healthy rollover of 70% closed above it.

- Total Future & Option trading volume at 14.84 Lakh core with total contract traded at 2 lakh , PCR @0.98

- FII’s sold 375 cores and DII’s sold 523 cores in cash segment.INR closed at 64.88

- Nifty Futures Trend Deciding level is 10339 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10339. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10355 Tgt 10375,10400 and 10425 (Nifty Spot Levels)

Sell below 10320 Tgt 10299,10270 and 10250 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh