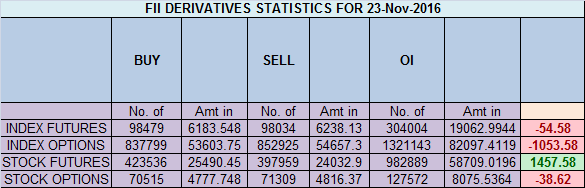

- FII’s sold 445 contract of Index Future worth 54 cores ,7.3 K Long contract were added by FII’s and 6.9 K short contracts were added by FII’s. Net Open Interest increased by 14.2 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures.

- As discussed in last analysis Holding 7916 we might has formed a short term bottom and see rally till 8130/8270. Bulls on close above 8010 can see fast move towards 8060/8100 in next 2 session. Bears will get active below 7900 and in between 7900-8010 it will be volatile expiry moves. High made today was 8055 and closed above 8010 suggesting bulls are getting their foot back but we need a weekly close above 8010 to presume short term bottom is in place. Above 8060 we can see quick move towards 8100/8130. Bearish only on close below 7900 in between 7900-8010 choppy move continues Bank Nifty held on to gann angle,EOD Analysis

- Nifty Nov Future Open Interest Volume is at 1.27 core with liquidation of 25 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @8705 made high at 8704 on 01 Nov and correction of 700 points.

- Total Future & Option trading volume at 5.36 Lakh core with total contract traded at 1.8 lakh , PCR @0.81.

- 8200 CE is having Highest OI at 53.5 lakh, resistance at 8200 followed by 8100 .7900/8200 CE added 5.4 lakh so bears liquidated aggressively 8050/8150 PE .FII bought 1.6 K CE longs and 12.5 K CE were shorted by them .Retail bought 22.1 K CE contracts and 15.2 K CE were shorted by them.

- 8000 PE OI@51.6 lakhs having the highest OI strong support at 8000. 7900-8200 PE added 7.2 Lakh in OI so bulls added in 8000/8050 PE. FII sold 7.7 K PE longs and 3.5 K shorted PE were covered by them .Retail bought 47.5 K PE contracts and 27.9 K shorted PE were covered by them.

- FII’s sold 1013 cores in Equity and DII’s bought 1254 cores in cash segment.INR closed at 68.56

- Nifty Futures Trend Deciding level is 8016 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8359. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8020 Tgt 8034,8065 and 8100 (Nifty Spot Levels)

Sell below 7980 Tgt 7955,7930 and 7905 (Nifty Spot Levels)

Upper End of Expiry:8102

Lower End of Expiry:7957

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Hello Sir. What is the implication of negative COC like today on nifty index

Rollover with negative cost of carry suggests underlying weakness in indices