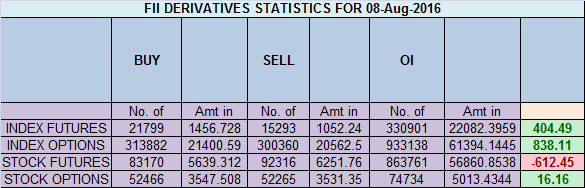

- FII’s bought 6.5 K contract of Index Future worth 404 cores ,7.3 K Long contract were added by FII’s and 0.8 K short contracts were liquidated by FII’s. Net Open Interest increased by 8.2 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. The Thinking of the Average Trader

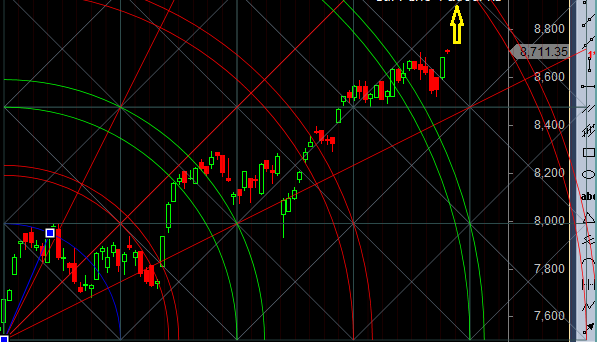

- As discussed in Yesterday Analysis Also as per gann analysis close above 8577 will be bullish. Best is to go long above 8607 which is falling gann line as shown below add more if it close above 8677 for eventual target of 8752, Adding to winning position is called pyramiding which most of professional traders do. Nifty made high of 8723 almost near 8752 target of ABCD patter, Bulls need to protect 8677 in any correction to continue upmove towards 8800/8851 zone as seen in below gann chart. Expect volatile move tomorrow as its rbi day and gann turn date also, trade with caution Bank Nifty takes breather before RBI policy,EOD Analysis

- Nifty Aug Future Open Interest Volume is at 2.46 core with addition of 2.46 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @8650, closed above it and gained 70 points.

- Total Future & Option trading volume was at 1.94 Lakh core with total contract traded at 0.89 lakh , PCR @1.04, Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 48 lakh, resistance at 8800 .8500/9000 CE liquidated 10.6 lakh so resistance formation in 8800-8900 but cracks visible at higher level .FII bought 1.7 K CE longs and 4.5 K shorted CE were covered by them .Retail bought 8.9 K CE contracts and 14.8 K CE were shorted by them.

- 8500 PE OI@56.2 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 5.5 Lakh in OI so bulls making strong base near 8550-8600 zone .FII bought 8.7 K PE longs and 1.4 K PE were shorted by them .Retail bought 32 K PE contracts and 21.6 K PE were shorted by them.

- FII’s bought 1156 cores in Equity and DII’s bought 876 cores in cash segment.INR closed at 66.84

- Nifty Futures Trend Deciding level is 8742 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8670 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8725 Tgt 8752,8775 and 8800 (Nifty Spot Levels)

Sell below 8685 Tgt 8650,8630 and 8600 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Looks like the negative divergences have shown their effect on the price finally. In any case after doji (which shows indecision) and a bearish engulfing candle to boot, the fall is not really surprising.

yes thats perfect..

stochastic indicator is also not touching highs despite nifty making new highs since 14-15 July. can it be termed as negative divergence and change of momentum.

all negative divergence need follow up move of price else they stand negated..

There seem to be negative divergences seen on nifty chart. While the price continues to make new highs, volumes are not larger and RSI is not making new highs. Do you these warning signs fit into the technical picture

all negative divergence need follow up move of price else they stand negated..