Hindalco

Positional Traders can use the below mentioned levels

Close above 139 Tgt 144/149

Intraday Traders can use the below mentioned levels

Buy above 136.6 Tgt 138,139.5 and 141.5 SL 135.9

Sell below 135 Tgt 133.8,131.8 and 130 SL 135.9

Biocon

Positional Traders can use the below mentioned levels

Close above 717 Tgt 747/765

Intraday Traders can use the below mentioned levels

Buy above 717 Tgt 721,727.5 and 741 SL 713

Sell below 708 Tgt 704,697 and 691 SL 712

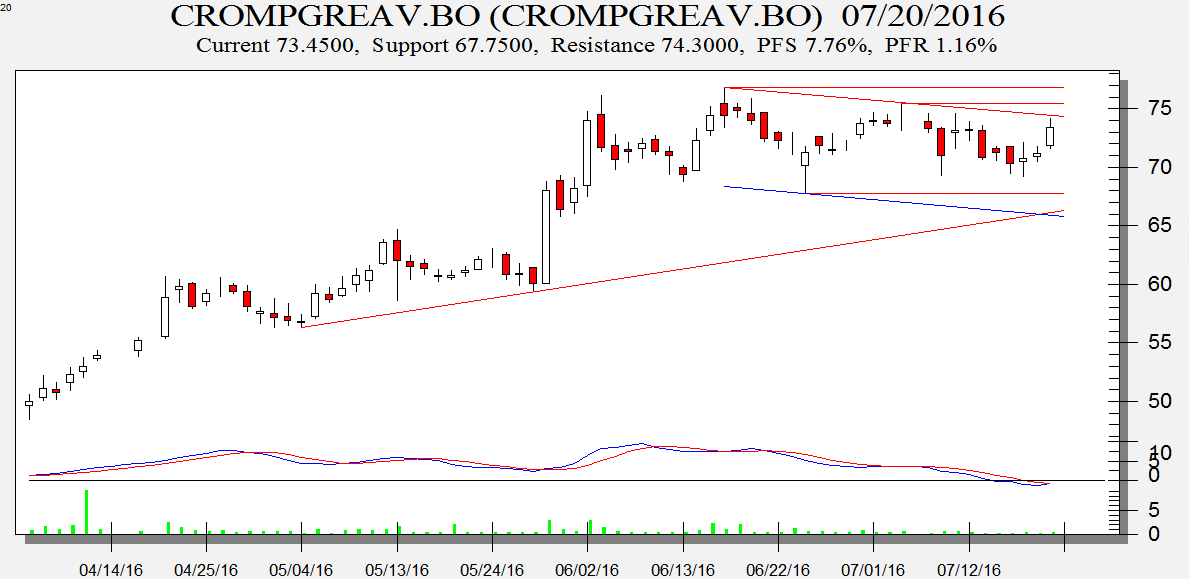

Crompton Greaves

Positional Traders can use the below mentioned levels

Close above 74 Tgt 76/80

Intraday Traders can use the below mentioned levels

Buy above 74 Tgt 74.7,75.8 and 77 SL 73.5

Sell below 72.9 Tgt 71.8,71 and 70 SL 73.5

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for June Month, Intraday Profit of 3.12 Lakh and Positional Profit of 3.08 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/14011718

Sir,i want to earn thru share trading.will u guide me?What is the procedure to get advice from u.how much initial capital investment is required.

I post my analysis please use it to plan your trades.

Barmesh,and Om sir excellent what a blast stock……wawa

But hindalco reached stop loss twice,crompton also reached buy stop loss.Or am I interpreting it wrong?

Cromp O=H so no buy trade taken

Hindalco as we were waiting for result so trade was taken after 2:30 PM

At what time you give intraday advice…like before beginning of trading session of day or in-between . Thanx

Its before market opening, You can like Facebook page to get reall time updates..

do you give long term chart reading also sir

Nope

1st, time after an year bramesh sir and my selected stock same stock is biocon

thanks