- FII’s bought 8.4 K contract of Index Future worth 558 cores ,8.9 K Long contract were added by FII’s and 0.5 K short contracts were added by FII’s. Net Open Interest increased by 9.5 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. Trading Lesson Learnt From my Trading Guru Part-II

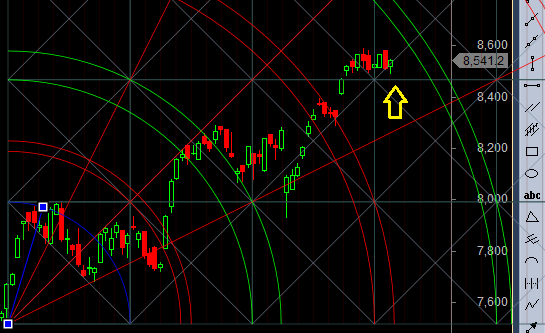

- As discussed in Yesterday Analysis Bulls should protect 8490 else we can see a quick correction till 8410-8400. Bullish on close above 8577 for target of 8650, Expect impulsive move in next 2 trading sessions. Low made was 8489 so bears unable to close below 8490 and Bulls also unable to close above 8577 gann number, suggesting fight between bulls and bears for close below 8490 or above 8577. Close above 8577 or below 8490 can see a move of 100 points. Beauty of this bull run from 6825 is time correction, current move also its 9 days we have been trading in range of 8594-8476 suggesting time correction and another trending move of 200-250 points on cards. Bank Nifty does gann target of 18550,EOD Analysis

- Nifty July Future Open Interest Volume is at 2.32 core with addition of 1.3 Lakh with decrease in cost of carry suggesting long position were added today, NF Rollover is at 73% and Rollover cost @8204 closed above it

- Total Future & Option trading volume was at 3.1 Lakh core with total contract traded at 1.2 lakh , PCR @1.02 , Trader’s Resolutions for the New Financial Year 2016-17

- 8600 CE is having Highest OI at 61.7 lakh, resistance at 8600 .8400/8700 CE liquidated 10.2 lakh still resistance at higher levels, at 8600-8650 zone .FII sold 15.4 K CE longs and 2.4 K CE were shorted by them .Retail bought 18.8 K CE contracts and 8.7 K CE were shorted by them.

- 8400 PE OI@58.3 lakhs having the highest OI strong support at 8400. 8200-8600 PE added 6.5 Lakh in OI so bulls making strong base near 8300-8400 zone .FII bought 5.3 K PE longs and 4.8 K PE were shorted by them .Retail bought 34.5 K PE contracts and 8.8 K PE were shorted by them.

- FII’s bought 437 cores in Equity and DII’s sold 365 cores in cash segment.INR closed at 67.08

- Nifty Futures Trend Deciding level is 8538 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8466 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8564 Tgt 8585,8622 and 8650 (Nifty Spot Levels)

Sell below 8520 Tgt 8500,8470 and 8445 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

trending move of 200-250 points on cards

Sir do it mean towards existing. upward. trend OR it can be either way

8490 /8577 holds the key..

You are a Real Hero in my Life… How can you make Such exact predictions…!!!

Sir… You are a Genious… Hats Off to you.

Dear Sir,

Just follow system and always be grounded..

Sir type mistake gann number 5877 instead of 8577please correct it.

thanks corrected..