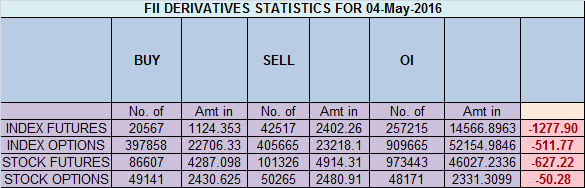

- FII’s sold 21.9 K contract of Index Future worth 1277 cores ,19.7 K Long contract were liquidated by FII’s and 2.2 K short contracts were added by FII’s. Net Open Interest decreased by 17.5 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures. Stop Gambling Start Trading

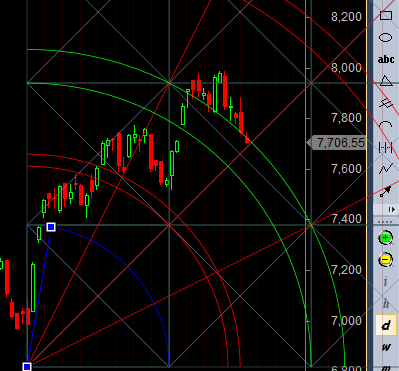

- As discussed in last analysis If we close above 7850 on weekly basis can see move back to 7950-7972 range and weekly close below 7850 can see move towards 7750-7700. Nifty made low of 7697 does the target of 7700 near gann support line as shown in below chart, If we hold this line we can see bounceback till 7800/7850 range. Unable to close above 7850 in bounce back we can fall all the way till 7546-7501 in next 2-3 weeks Bank Nifty continues downmove,EOD Analysis

- Nifty April Future Open Interest Volume is at 1.91 core with liquidation of 6 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @7953, continue to trade below it.

- Total Future & Option trading volume was at 1.63 Lakh core with total contract traded at 2.4 lakh , PCR @0.80, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 55.5 lakh, resistance at 8000 .7500/8000 CE added 17 lakh so bears added position on higher level and will hold till nifty do not close above 7972 .FII bought 1 K CE longs and 25 K CE were shorted by them .Retail bought 55 K CE contracts and 13.5 K CE were shorted by them.

- 7700 PE OI@40 lakhs having the highest OI strong support at 7700. 7200-7700 PE added 3.6 Lakh in OI so strong base near 7500-7600 zone .FII bought 20.2 K PE longs and 4 K PE were shorted by them .Retail sold 10 K PE contracts and 14.3 K PE were shorted by them. FII’s added aggressive Nifty put at start of series, high of 7950 not broken bias remain bearish. High made today 7950

- FII’s sold 66 cores in Equity and DII’s sold 78 cores in cash segment.INR closed at 66.55

- Nifty Futures Trend Deciding level is 7755 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7854 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7720 Tgt 7737,7760 and 7789 (Nifty Spot Levels)

Sell below 7695 Tgt 7665,7640 and 7600(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Nifty Spot. Levels. Are of yesterday pls check

Today Nifty Futures Trend Deciding level is 7755.Nifty trade above level & trigger this level both side again & again…In this case What is stop loss we maintain.. Please your valuable advise sir

7755 is TD level if NF sustains above that level for 5 mins long can be taken with 20 points as SL and Tgt 20-25 points than Trail it..

Please backtest it for 2-3 months than take live trade..

Any given day SL gets triggred 2 times in a day no further trade to be taken.

Rgds,

Bramesh

Bramesh ji.. do you see any probability of bullish shark pattern starting near 7500 levels on nifty daily.. prz of which also falls between 38%-50% fibonacci rerracement of important lows.

yes perfect !!