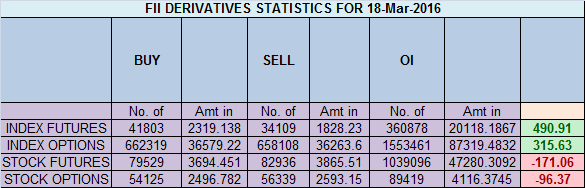

- FII’s bought 7.6 K contract of Index Future worth 490 cores ,16.1 K Long contract were added by FII’s and 8.4 K short contracts were added by FII’s. Net Open Interest increased by 24.5 K contract, so rise in Nifty market was used by FII’s to enter long and enter shorts in Index futures.How To Get What I Want

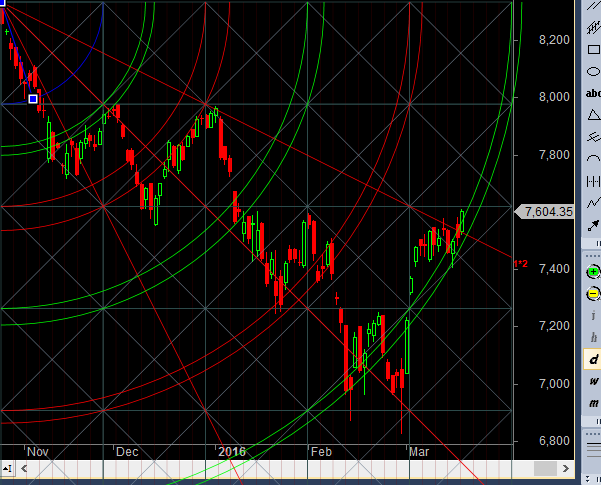

- As discussed in Last Analysis Nifty opened with gap up made high of 7585 and again unable to close above both gann trendline and demand zone of 7554, but again was able to held on to gann arc, suggesting bulls are in control. Nifty gann arc again helped us and bulls showed true colors by closing at 7600 and also closing above the gann trendline . Close above 7634 is important for a move towards 7800/7900, Bears have chance only on close below 7450. Bank Nifty Breaks gann trendline,EOD Analysis

- Nifty March Future Open Interest Volume is at 2.22 core with addition of 7.7 Lakh with increase in cost of carry suggesting long position were added today, NF closed above Rollover cost @7147. Nifty rallied 500 points above Rollover cost

- Total Future & Option trading volume was at 3.46 Lakh core with total contract traded at 2.11 lakh , PCR @1.02, .How To Identify Market Tops and Bottom

- 7700 CE is having Highest OI at 71.3 lakh, resistance at 7500 .7000/7500 CE liquidated 5 lakh so bears ran for cover as Nifty bounced from demand zone .FII bought 20.6 K CE longs and 12.1 K CE were shorted by them .Retail sold 41.1 K CE contracts and 5.4 K shorted CE were covered by them.

- 7400 PE OI@72.7 lakhs having the highest OI strong support at 7400 base becoming strong. 7200-7600 PE added 24.6 Lakh in OI .FII bought 4.1 K PE longs and 8.4 K PE were shorted by them .Retail bought 48.2 K PE contracts and 7.1 K PE were shorted by them.

- FII’s bought 1712 cores in Equity and DII’s sold 403 cores in cash segment.INR closed at 66.50

- Nifty Futures Trend Deciding level is 7572 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7378 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7640 Tgt 7674,7701 and 7735 (Nifty Spot Levels)

Sell below 7570 Tgt 7545,7520 and 7480 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-140117182685863/

Amitrader

Sir plz do provide any free technical analysis software which is available online waiting desperately for ur ans….

Dear Mam,

When my money is at stake I do not look for FREE things, I go for the best in town. YOu can try chartnexus.

Rgds,

Bramesh

sir, I AM GREAT FAN OF YOUR WEBSITE AND EARN GOOD MONEY. i agree with your all datas given above. i.e. “FII bought 20.6 K CE longs and 12.1 K CE were shorted by them .Retail sold 41.1 K CE contracts and 5.4 K shorted CE were covered by them.” BUT I DID FIND THIS DATA ON NSE SITE CAN U PROVIDE ME LINK OF THIS DATA PLEASE.

We have developed a program for that.