- FII’s bought 14.8 K contract of Index Future worth 861 cores ,8 K Long contract were added by FII’s and 6.8 K short contracts were liquidated by FII’s. Net Open Interest increased by 1.1 K contract, so rise/fall in Nifty market was used by FII’s to enter long and exit shorts in Index futures. How to Unlock Trading Success

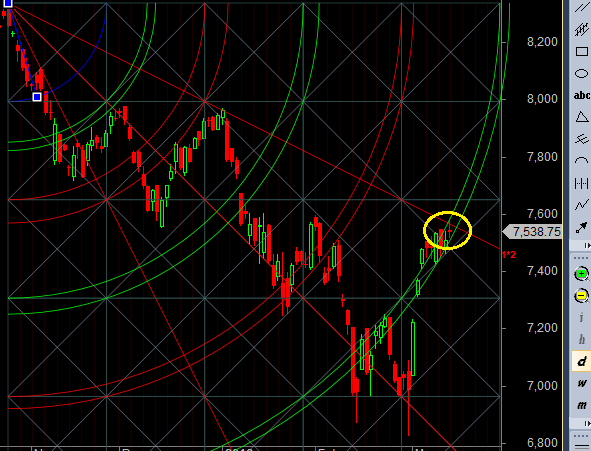

- Nifty moved above 7554 but got resisted at gann trend line as shown below, Also unable to close above supply zone of 7554 as we have been discussing, Bulls need close above 7554 for a move towards 7634. Bears below 7400 for some short term correction else it will be sideways move in small range. Bank Nifty continues to trade in gann arc,EOD Analysis

- Nifty March Future Open Interest Volume is at 2.17 core with liquidation of 2.4 Lakh with increase in cost of carry suggesting short position were closed today, NF closed above Rollover cost @7147. Nifty rallied 300 points above Rollover cost

- Total Future & Option trading volume was at 1.97 Lakh core with total contract traded at 1.44 lakh , PCR @0.98, .How To Identify Market Tops and Bottom

- 7500 CE is having Highest OI at 66.3 lakh, even though Nifty trading above 7500 suggesting CE writer not panicking, Will start feeling pain once Nifty is trading above 7600 .7000/7500 CE liquidated 10 lakh so bears ran for cover in 7400/7500 CE .FII bought 3.7 K CE longs and 3.3 K CE were shorted by them .Retail bought 12.3 K CE contracts and 13.9 K CE were shorted by them.

- 7200 PE OI@66.3 lakhs having the highest OI strong support at 7200 base becoming strong. 7200-7600 PE added 15 Lakh in OI .FII bought 2.7 K PE longs and 1.2 K shorted PE were covered by them .Retail bought 26.2 K PE contracts and 6.8 K shorted PE were covered by them.

- FII’s bought 1035 cores in Equity and DII’s sold 805 cores in cash segment.INR closed at 67.11

- Nifty Futures Trend Deciding level is 7559 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7328 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7550 Tgt 7575,7600 and 7632 (Nifty Spot Levels)

Sell below 7500 Tgt 7470 ,7442 and 7415 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-140117182685863/

” so rise/fall in Nifty market was used by FII’s to enter long and exit shorts in Index futures”

Sirji something is missing in interpretation , bcas Nifty felled today while FII are entering in Futures Any thoughts ??

Can yesterday’s daily candle be considered as a gravestone doji ?