Hindalco

Positional/Swing Traders can use the below mentioned levels

Close above 86 Tgt 89/92

Intraday Traders can use the below mentioned levels

Buy above 86.5 Tgt 87.5,89 and 90 SL 85.5

Sell below 84 Tgt 83,82 and 80.9 SL 85

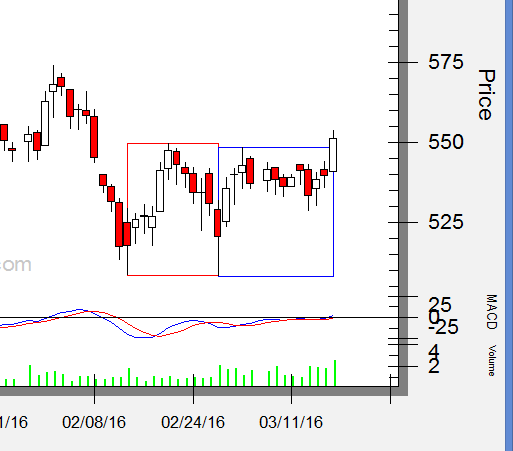

Wipro

Positional/Swing Traders can use the below mentioned levels

Close above 555 Tgt 576/589

Intraday Traders can use the below mentioned levels

Buy above 553 Tgt 556.5,560 and 565 SL 551

Sell below 548 Tgt 544,540 and 536 SL 551

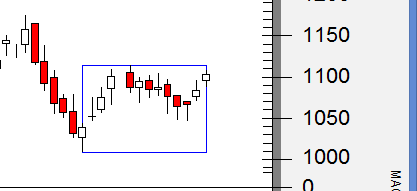

BEL

Intraday Traders can use the below mentioned levels

Buy above 1105 Tgt 1111,1120 and 1131 SL 1098

Sell below 1097 Tgt 1091,1080 and 1071 SL 1102

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for February Month, Intraday Profit of 5.09 Lakh and Positional Profit of 2.89 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Superb analysis sir.