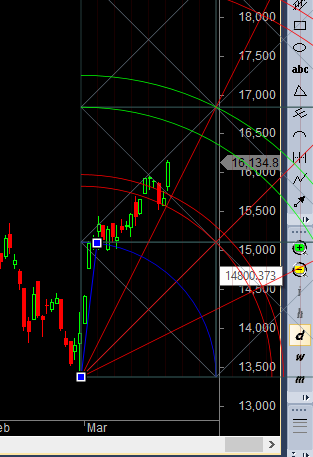

- As discussed in last analysis The range is important as its falling in gann 1 arc and near gann trendline as shown in below chart, so break of 15500 or 15800 will give another 250-300 point move.Nifty made low of 15762 and opened above the gann arc, and once 15800 was broken gave the 300 point move we were looking for. Never follow new, follow levels with proper risk management market has everything factored in.16200-16229 is important supply zone for bank nifty, closing above it we can see move towards 16800 on/before RBI policy. Support will increase to 15700-15750 range. Which type of a trader are you?

- Bank Nifty April Future Open Interest Volume is at 12.9 lakh with addition of 3.5 lakh, with increase in Cost of Carry suggesting long positions were added today.Rollover for Bank Nifty is at 49.4 % and rollover cost @15930 How To Identify Market Tops and Bottom

- 16500 CE is having highest OI @4.2 Lakh resistance formation @16500. 15000-16000 CE liquidated 11 lakh as bears ran for cover in 16000/16100 CE .Hope this helped trades, Maximum addition was seen @15800, so break and close of 15800 will first indication of bank nifty going bullish tomorrow.

- 15800 PE is having highest OI @2.9 Lakh, strong support at 15800 followed by 15600, Bulls again added in 15800/16100 PE as OI increased by 7.3 Lakh so bulls finally held on to 15800.

- Bank Nifty Futures Trend Deciding level is 15985(For Intraday Traders). BNF Trend Changer Level (Positional Traders) 15199 . Bank Nifty TC level gave 1000 points till now.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 16200 Tgt 16280,16360 and 16450 (Bank Nifty Spot Levels)

Sell below 16000 Tgt 15880,15760 and 15616 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

never follow news bharani ji

Thank you Sir.

Sir,

Buy above 16200 Tgt 16280,15360 …

It should be 16360, kindly note sir

Will bank nifty go up or down? Please advice

Dear Sir,

Good Morning !!

Can you please explain this line.. “Never follow new, follow levels with proper risk management market has everything factored in.”

Thanks

Buy target in TC level….16360?