Dr Reddy

Intraday Traders can use the below mentioned levels

Buy above 3130 Tgt 3150,3178 and 3211 SL 3115

Sell below 3095 Tgt 3080,3050 and 3030 SL 3108

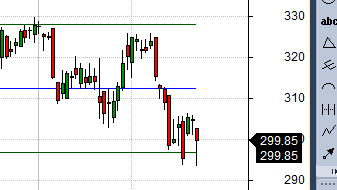

ITC

Intraday Traders can use the below mentioned levels

Buy above 300 Tgt 302,306 and 310 SL 298

Sell below 297 Tgt 294.8,293 and 289 SL 298.5

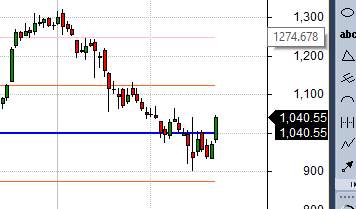

BEML

Positional/Swing Traders can use the below mentioned levels

Close above 1042 Tgt 1076

Intraday Traders can use the below mentioned levels

Buy above 1050 Tgt 1068,1095 and 1130 SL 1040

Sell below 1020 Tgt 1008,994 and 978 SL 1030

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for January Month, Intraday Profit of 3.57 Lakh and Positional Profit of 4.36 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Thanks bramesh for the ideas 🙂