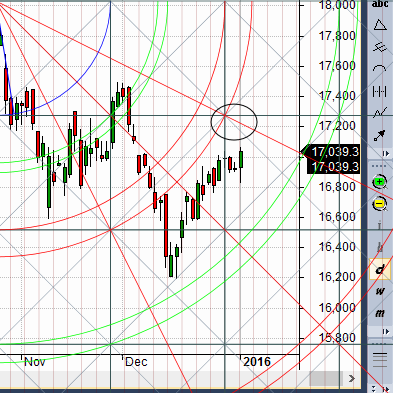

- Bank Nifty corrected till 16824 level in intraday near demand zone of 16860 and bounced back sharply,and now is heading towards the gann resistance line of 1×2 which comes around 17220-17250.New Year Resolutions for Trading Success

- Bank Nifty December Future Open Interest Volume is at 17.5 lakh with addition of 0.58 Lakh .Bank Nifty rollover cost coming @ 16957 and rollover stands at 68.3 .Can Traders make money in Stock market?

- 17500 CE is having highest OI @3.6 Lakh strong resistance formation @17500. 17000 CE added 0.38 lakh so bears added their positions on partial manner.16500-17500 CE liquidated 1.66 Lakh in OI.

- 16500 PE is having highest OI @2.6 lakh, strong support at 16500 followed by 16000 PE .16000-17000 PE added 2.05 Lakh in OI aggressive addition was seen by Bulls.

- Bank Nifty Futures Trend Deciding level is 17010 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 16998.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 17070 Tgt 17130,17200 and 17350 (Bank Nifty Spot Levels)

Sell below 16950 Tgt 16890,16830 and 16750(Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Thanks a lot for sending. Pl. send the same about Nifty & Reliance communication..

Regards.

Thanks Brahmesh ji. Can you please give us some explanation on how to calculate the rollover cost for nifty and banknifty

Happy New Year Manikji I cover the same in my trading course.