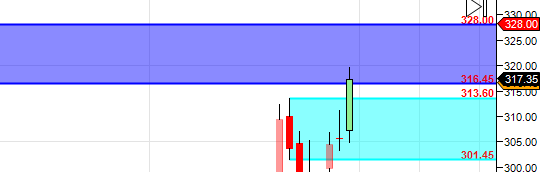

Arvind

Positional/Swing Traders can use the below mentioned levels

Close above 322 Target 328/336/344

Intraday Traders can use the below mentioned levels

Buy above 320 Tgt 322,325 and 328.5 SL 318

Sell below 316 Tgt 313,311 and 308 SL 318

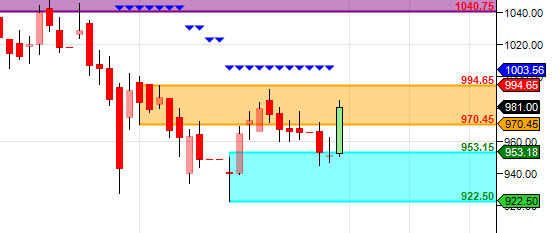

Glenmark

Positional/Swing Traders can use the below mentioned levels

Close above 987 Target 1008/1021

Intraday Traders can use the below mentioned levels

Buy above 985 Tgt 993,1000 and 1008 SL 981

Sell below 970 Tgt 960,950 and 938 SL 975

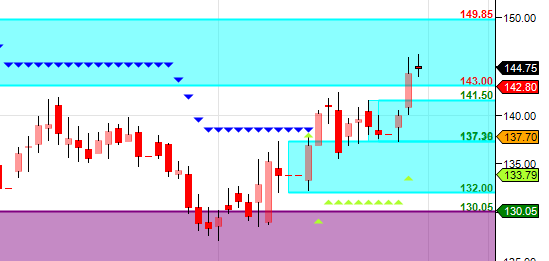

PNB

Positional/Swing Traders can use the below mentioned levels

Close above 145 Target 149/152

Intraday Traders can use the below mentioned levels

Buy above 145 Tgt 146,147 and 149 SL 144

Sell below 142.5 Tgt 141.5,139 and 136 SL 144

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for November Month, Intraday Profit of 4.14 Lakh and Positional Profit of 5.08 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Sir, Positinal Calls are not getting initiated.Is it due to choppy market?

We have whole expiry waiting, If Level comes trades will be taken else stay out and wait patiently for opportunity.

Rgds,

Bramesh