- FII’s sold 2.9 contract of Index Future worth 175 cores ,1.9 K Long contract were liquidated by FII’s and 1 K short contracts were added by FII’s. Net Open Interest decreased by 902 contract, so today’s fall in market was used by FII’s to exit long and add shorts in Index futures.Major Problem Faced by Traders :Pulling The Trigger

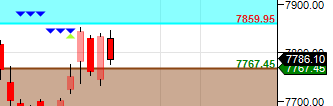

- As discussed in last analysis Nifty needs to close above 7860 range for a move towards 7979 range, Unable to close above can again make nifty test 7767 range.Nifty again got stalled near 7860 zone , High made today was 7846 and correction started as we discussed made low of 7776, Bulls needs to close above 7860 and bears below 7767 for trending move else market will be in range bound move Bank Nifty again resisted at gann line,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.84 core with liquidation of 1 Lakh with decrease in CoC suggesting long position were closed today. Nifty closing below rollover cost 7896.

- Total Future & Option trading volume was at 2.10 Lakh core with total contract traded at 1.34 lakh , PCR @0.83.

- 8000 CE OI at 76 lakh , wall of resistance @ 8000 .7600/8000 CE added 8.3 lakh in OI as bears added again 7800/7900 CE.FII sold 10 K CE longs and 20.4 K shorted CE were covered by them .Retail bought 27.4 K CE contracts and 21.1 K CE were shorted by them.

- 7500 PE OI@52.7 lakhs strong base @ 7500. 7600/8000 PE liquidated 5 lakh so bulls started liquidation after 2 days of wait as nifty is still unable to cross above the supply zone of 7860.FII sold 336 PE longs and 2 K shorted PE were covered by them .Retail sold 6.7 K PE contracts and 5.9 K shorted PE were covered by them.

- FII’s bought 168 cores in Equity and DII’s bought 238 cores in cash segment.INR closed at 66.32

- Nifty Futures Trend Deciding level is 7815 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7815 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7805 Tgt 7830,7860 and 7890 (Nifty Spot Levels)

Sell below 7760 Tgt 7735,7715 and 7690 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Do you see and Head and Shoulder pattern development in Nifty?

Not a Big Fan of Patterns..