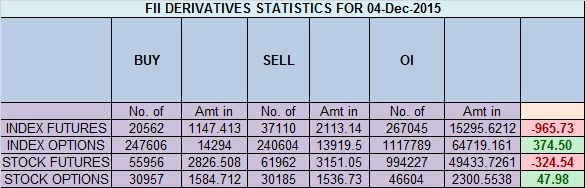

- FII’s sold 16.5 K contract of Index Future worth 965 cores ,10.5 K Long contract were liquidated by FII’s and 6 K short contracts were added by FII’s. Net Open Interest decreased by 4.4 contract, so today’s fall in market was used by FII’s to exit long and enter shorts in Index futures. Nifty Options-What happens on Expiration day?

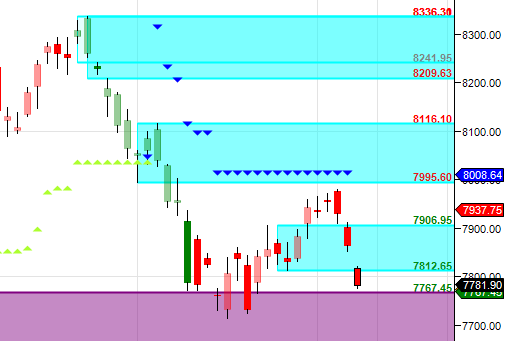

- As discussed yesterday For next 2 days if 7906 broken we can go towards 7851/7812. Bullish only on close above 7994. Nifty did the target of 7812 and took support near 7767 which is a strong demand zone, Holding the same and close above 7812 can see fast move till 7906/7995. Bank Nifty near gann arc,Will it Bounce again ?

- Nifty December Future Open Interest Volume is at 1.95 core with addition of 1.8 Lakh with increase in CoC suggesting long position were added today. Nifty closing above rollover cost 7896.

- Total Future & Option trading volume was at 1.51 Lakh core with total contract traded at 1.19 lakh , PCR @0.75.

- 8000 CE OI at 55.7 lakh , wall of resistance @ 8000 .7800/8500 CE added 8.1 lakh in OI as bears added position at higher level most of addition was seen in 8000/8300 CE.FII sold 3 K CE longs and 8.2 K CE were shorted by them .Retail bought 33.4 K CE contracts and 11.7 K CE were shorted by them.

- 7500 PE OI@ 51.5 lakhs strong base @ 7500. 7500/8000 PE added 3 lakh so bulls added position is 7700/7800 PE forming base at higher levels .FII bought 19.5 K PE longs and 1.1 K PE were by shorted them .Retail sold 2.8 K PE contracts and 16 K PE were shorted by them. Retailers playing for Bullish move with aggressive addition in CE

- FII’s sold 1745 cores in Equity and DII’s bought 1069 cores in cash segment.INR closed at 66.68.

- Nifty Futures Trend Deciding level is 7831 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7934 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7811 Tgt 7838,7856 and 7900 (Nifty Spot Levels)

Sell below 7790 Tgt 7765,7750 and 7720 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Hi Bramesh,

Please clarify my below doubt.

You mentioned that 8000 CE @ OI 55.7 Lakh which is a strong Resistance..

it means high OI at higher value indicates the resistance means this 55 lakh contracts had Sold 8000 CE call not Bought the 8000 CE calls.

Can we apply the same logic for Stocks also in Equity Chains? It means most of professionals write the options instead buying

Thanks for your response in Advance

-Praveen

bramesh sir need ur help as per tc level for nifty future is 7831 so if nifty do a gap down opening so i have to wait till it come above tc level and then buy and sell when it goes below tc level am i correct for trading in nifty futures

Please read this link

http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/