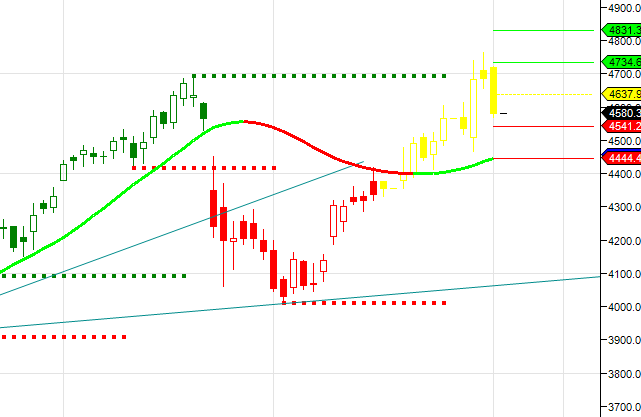

Maruti

Positional/Swing Traders can use the below mentioned levels

Close below 4558 Tgt 4414/4325

Intraday Traders can use the below mentioned levels

Buy above 4625 Tgt 4650,4678 and 4720 SL 4600

Sell below 4570 Tgt 4550,4525 and 4470 SL 4600

Sun Pharma

Positional/Swing Traders can use the below mentioned levels

Close above 898 Tgt 932/953

Intraday Traders can use the below mentioned levels

Buy above 892 Tgt 898,908 and 921 SL 888

Sell below 885 Tgt 878,870 and 864 SL 890

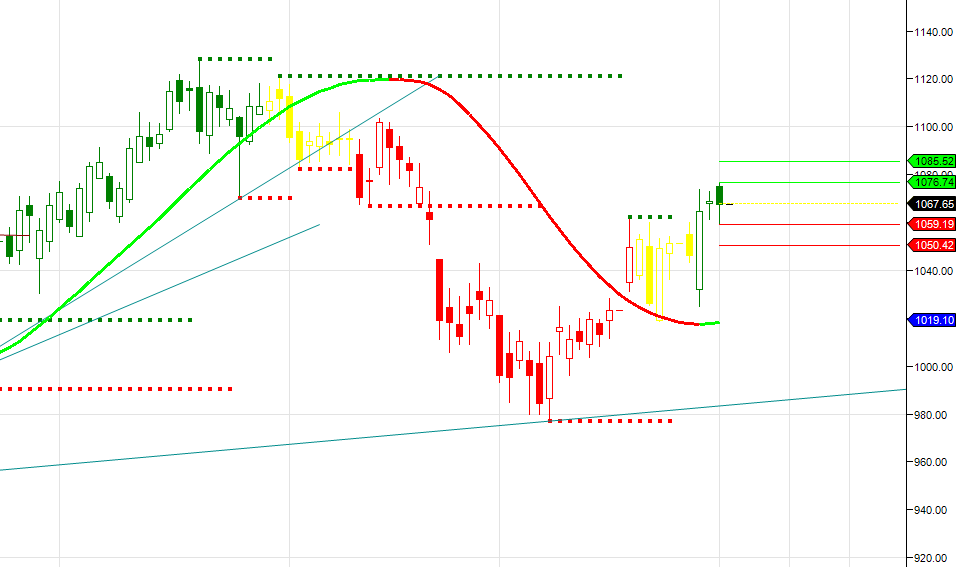

HDFC Bank

Positional/Swing Traders can use the below mentioned levels

Close above 1076 Tgt 1100/1131. Close below 1042 Tgt 1021/1008

Intraday Traders can use the below mentioned levels

Buy above 1070 Tgt 1076,1085 and 1094 SL 1066

Sell below 1064 Tgt 1060,1052 and 1042 SL 1068

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for September Month, Intraday Profit of 1.84 Lakh and Positional Profit of 1.93 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

(COPIED from Taxguru)

The meaning of turnover for in case of transactions in Futures and Options of shares is not defined under the I T Act In case of derivative trading-Futures and Option- the difference on which the contract is purchased or sold is important. Although the value of contract is number of contract multiplied with the shares price , yet what is actually given or taken is differential amount in contract. For example if you purchase a future contract for Rs 105 for a share having a lot of 100,you pay nothing at the time of buying a contract, yet at the time of expiry if contract , you are either gainer or loser which is determined whether there is positive or negative difference. So , for the purpose of determining the turnover in case of future and options , for the purpose of 44AB , based on the guidance note of ICAI , following items should be considered to constitute turnover:-

The total of positive and negative differences , plus Premium received on sale of options is also to be included in turnover ,plus In respect of any reverse trades entered, the difference thereon But not the total value of contract.

Thanks for Sharing.

Mr. Bramesh,

I know the returns are based on the over all p/l, my point is as you have been giving such small targets which could sum up at the end of the year and as I have been following your entry/exit levels with less than 3% profits overall, what do you do if you trade personally on your own views from the Income tax audit point of view as the profits are less than 8% of the sales. PLEASE IGNORE FNO TRANSACTIONS FOR THIS CASE. IS AN AUDIT NECESSARY? WHAT ABOUT THE TAX TREATMENT OF THE SAME.

Regards,

Dear Sir,

As a short term trader my target are always in range of 3-5%. Rest my CA does the job.

Rgds,

Bramesh

Mr. Bramesh,

I know your CA does the job but WHAT? KINDLY CLARIFY OR SAY YOU DON’T KNOW ASAT.

Enjoy.

Dear Sudhin,

Job of CA is to file IT returns its ASAT.

Njoy !!

Rgds,

Bramesh

Mr. Bramesh,

Yes I know the job of a CA is to file the returns, but I am asking you what was the outcome can you share if it’s fine else thanks and sorry for wasting your valuable time, no hard feelings buddy.

Enjoy and chill out dude..

Mr Sudhin,

This is not my area of expertise so I do what my CA ask me to do.

Rgds,

Bramesh

Under what section of the IT act is this given in black and white? My CA says it is the common thought process please show me as the per the act that this is the method? Any way I do only the cash segment so this will not help, but what if the cash segment profit is less than 8% of the sales then is an audit necessary? Finally assume an audit is done how are the profits taxed @ 15% or in the bracket in which the person is in? MY QUERY IS BASED ONLY FOR THE CASH SEGMENT NOT FNO.

Apt response!!!!

You have been giving targets with a profit margin of less than 8%, post that how does the Income tax view such trades? What about audit as the profit is less than 8%? I hope that you will clarify on this even though the sales value for the year is/maybe less than 1Cr in the cash segment ONLY. FNO HAS NOT BEEN CONSIDERED in the above.

Please talk your CA over this. We do not fill IT in trade to trade basis but overall P/L after end of Financial Year.

Rgds,

Bramesh