ACC

Positional/Swing Traders can use the below mentioned levels

Close below 1364 target 1330/1300

Intraday Traders can use the below mentioned levels

Buy above 1384 Tgt 1392,1400 and 1408 SL 1377

Sell below 1366 Tgt 1357,1345 and 1330 SL 1377

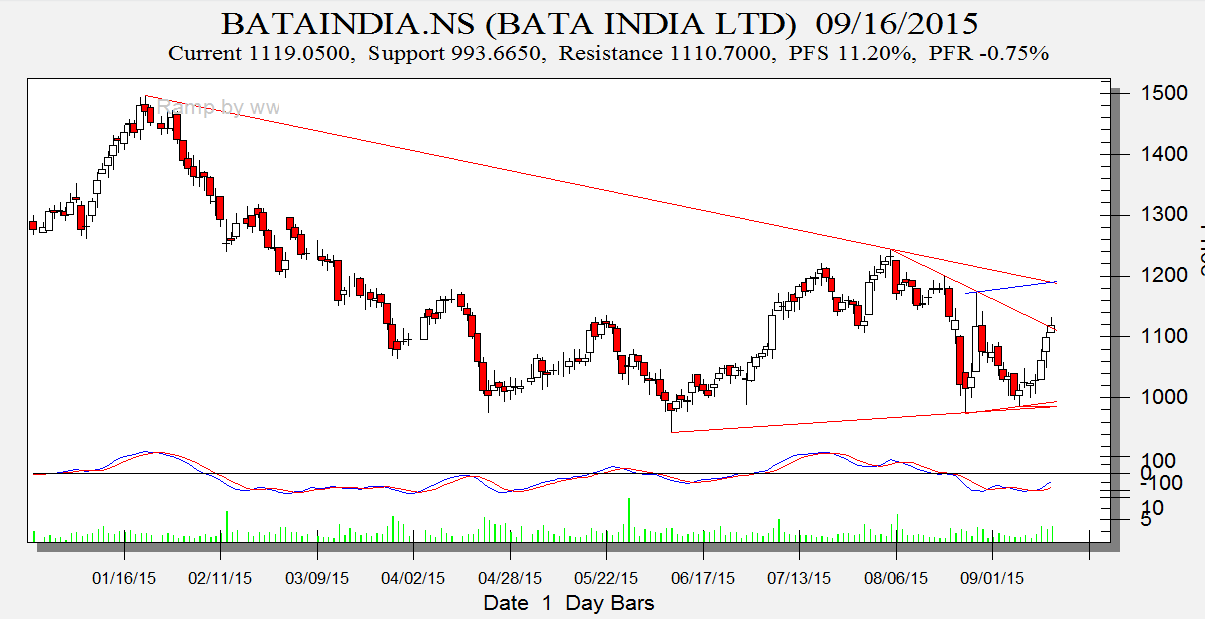

Bata India

Intraday Traders can use the below mentioned levels

Buy above 1132 Tgt 1145,1158 and 1174 SL 1120

Sell below 1115 Tgt 1105,1092 and 1080 SL 1125

Bharat Forge

Positional/Swing Traders can use the below mentioned levels

Close below 932 target 898

Intraday Traders can use the below mentioned levels

Buy above 950 Tgt 963,970 and 986 SL 940

Sell below 936 Tgt 927,920 and 913 SL 941

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for August Month, Intraday Profit of 2.01 Lakh and Positional Profit of 2.94 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Hi bramesh, Is it possible to get course course fee detail and date to my mail id please, moonvel.v@gmail.com, thanks

Hi bramesh, I just started watching your views, its really excellent calls. i saw your positional call for ACC and Bharat forge on 18 sep. But you initiated ACC sell call on 22 sep. my question is that if ACC did not close as per your view on the day (18 sep) meane will you follow up the call. if you follow the call means how many days validity. please send me your course fees to my mail id. thanks

Please read this link how to take positional calls

http://www.brameshtechanalysis.com/2014/08/how-to-trade-intraday-and-positional-calls/

Sir, the ACC went fantastic, but as you are giving both levels for selling or buying, sometimes it is confusing whether to buy or sell, for example Bharat Forge was stable above 950 for sometime more than 30 mins, but suddenly started going in downtrend which hit stoploss and later on it touched given on lower side, sir can you give any guideline parameter which help us to decide whether to sell or buy.

Practices market a trader perfect !!